Question: Exercise 1-5 (Static) Classifying costs LQ C2 Selected costs related to Apple's iPhone are listed below. Classify each cost as either direct materials, direct

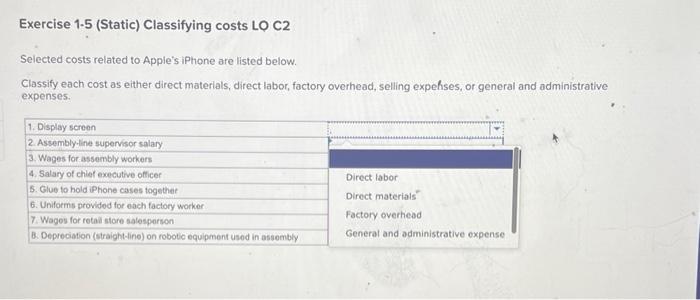

Exercise 1-5 (Static) Classifying costs LQ C2 Selected costs related to Apple's iPhone are listed below. Classify each cost as either direct materials, direct labor, factory overhead, selling expenses, or general and administrative expenses. 1. Display screen 2. Assembly-line supervisor salary 3. Wages for assembly workers 4. Salary of chief executive officer 5. Glue to hold iPhone cases together 6. Uniforms provided for each factory worker 7. Wages for retail store salesperson B. Depreciation (straight-line) on robotic equipment used in assembly Direct labor Direct materials Factory overhead General and administrative expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts