Question: Exercise 15-16 (LO. 3, 4) Exercise 15-19 (LO. 3,4) Henry, a freelance driver, finds passengers using various platforms such as Uber and Grubhub. He is

Exercise 15-16 (LO. 3, 4)

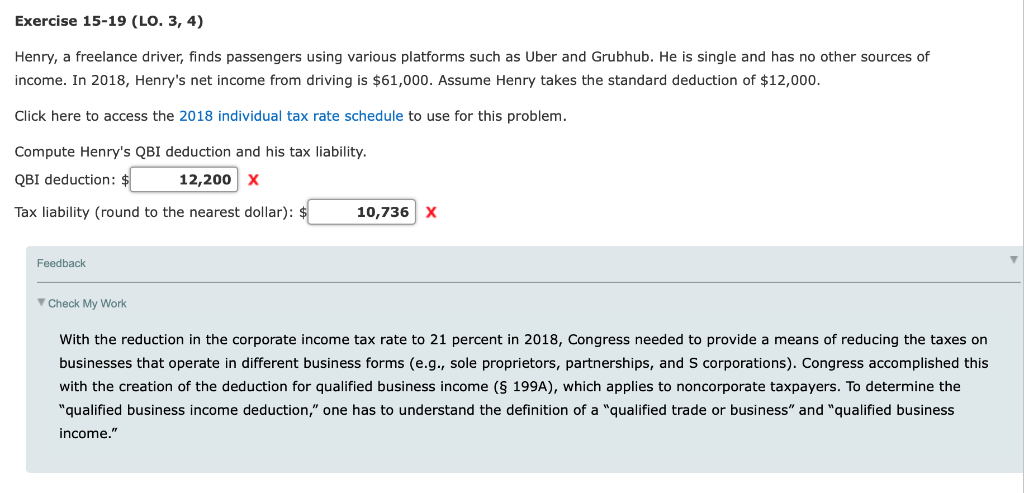

Exercise 15-19 (LO. 3,4) Henry, a freelance driver, finds passengers using various platforms such as Uber and Grubhub. He is single and has no other sources of income. In 2018, Henry's net income from driving is $61,000. Assume Henry takes the standard deduction of $12,000 Click here to access the 2018 individual tax rate schedule to use for this problem. Compute Henry's QBI deduction and his tax liability. Bl deduction: 12,200 x Tax liability (round to the nearest dollar): 10,736X Feedback Check My Work With the reduction in the corporate income tax rate to 21 percent in 2018, Congress needed to provide a means of reducing the taxes on businesses that operate in different business forms (e.g., sole proprietors, partnerships, and S corporations). Congress accomplished this with the creation of the deduction for qualified business income ( 199A), which applies to noncorporate taxpayers. To determine the "qualified business income deduction," one has to understand the definition of a "qualified trade or business" and "qualified business income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts