Question: Exercise 15-17A Computing foreign exchange gains and losses on receivables LO C3 On May 8, 2017, Jett Company (a U.S. company made a credit sale

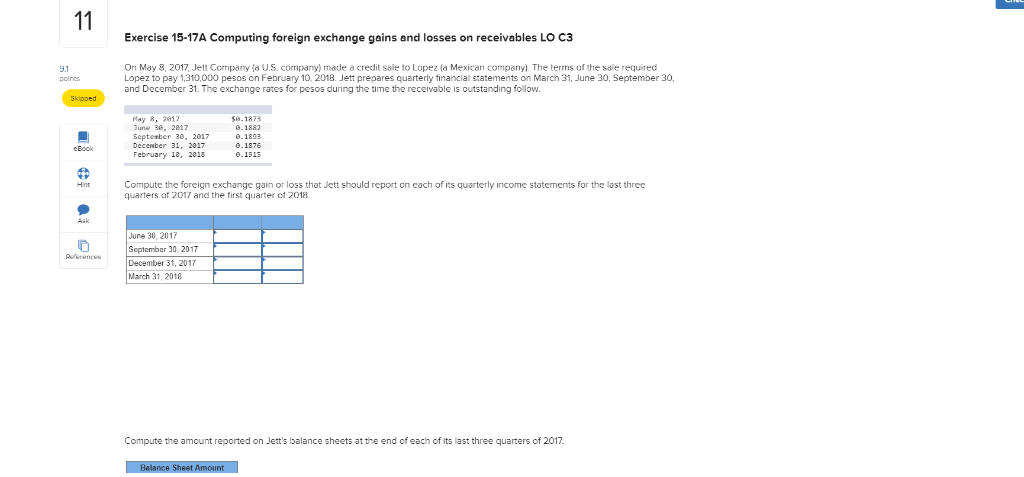

Exercise 15-17A Computing foreign exchange gains and losses on receivables LO C3 On May 8, 2017, Jett Company (a U.S. company made a credit sale to Lopez la Mexican company. The terms of the sale required Lopez to pay 1,310,000 pesos on February 10, 2018. Jett prepares quarterly financial statements on March 31, June 30, September 30, and December 31. The exchange rates for pesos during the time the receivable is outstanding follow. Skipped May 8, 2017 June 30, 2017 September 30, 2017 December 31, 2017 February 18, 2018 $0.1873 6.1882 8.1893 . 1976 cBook Compute the foreign exchange gain or loss that Jett should report on each of its quarterly income statements for the last three quarters of 2017 and the first quarter of 2018 June 30, 2017 September 30 2017 December 31, 2017 March 31, 2018 Compute the amount reported on Jett's balance sheets at the end of each of its last three quarters of 2017 Balance Sheet Amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts