Question: Exercise 15-18 (Algorithmic) (LO. 3, 4, 5) Maria and Javier are the equal partners in MarJa, a partnership that is a qualified trade or business.

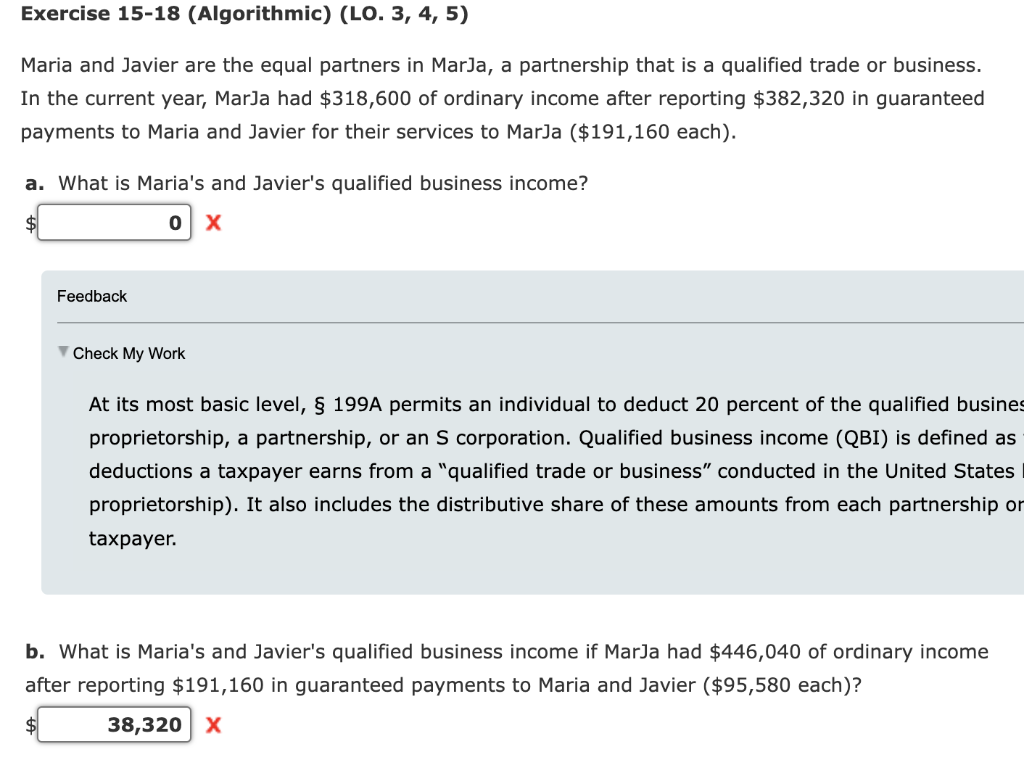

Exercise 15-18 (Algorithmic) (LO. 3, 4, 5) Maria and Javier are the equal partners in MarJa, a partnership that is a qualified trade or business. In the current year, MarJa had $318,600 of ordinary income after reporting $382,320 in guaranteed payments to Maria and Javier for their services to MarJa (\$191,160 each). a. What is Maria's and Javier's qualified business income? X Feedback Check My Work At its most basic level, 199A permits an individual to deduct 20 percent of the qualified busine proprietorship, a partnership, or an S corporation. Qualified business income (QBI) is defined as deductions a taxpayer earns from a "qualified trade or business" conducted in the United States proprietorship). It also includes the distributive share of these amounts from each partnership o taxpayer. b. What is Maria's and Javier's qualified business income if MarJa had $446,040 of ordinary income after reporting $191,160 in guaranteed payments to Maria and Javier ( $95,580 each)? $ x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts