Question: Exercise 15-19 (Algorithmic) (LO. 3, 4) Thad, a single taxpayer, has taxable income before the QBI deduction of $174,500. Thad, a CPA, operates an

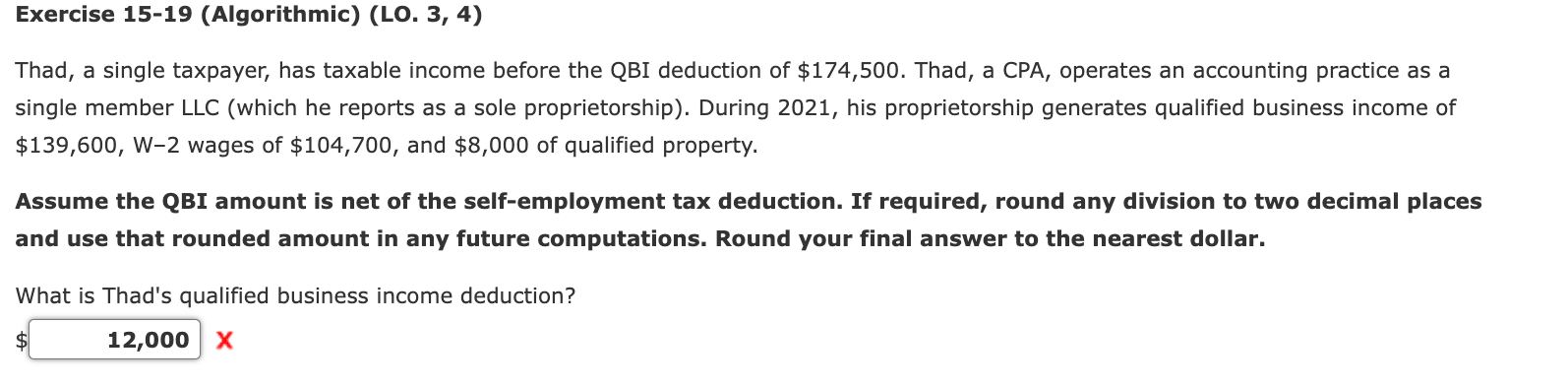

Exercise 15-19 (Algorithmic) (LO. 3, 4) Thad, a single taxpayer, has taxable income before the QBI deduction of $174,500. Thad, a CPA, operates an accounting practice as a single member LLC (which he reports as a sole proprietorship). During 2021, his proprietorship generates qualified business income of $139,600, W-2 wages of $104,700, and $8,000 of qualified property. Assume the QBI amount is net of the self-employment tax deduction. If required, round any division to two decimal places and use that rounded amount in any future computations. Round your final answer to the nearest dollar. What is Thad's qualified business income deduction? $ 12,000 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts