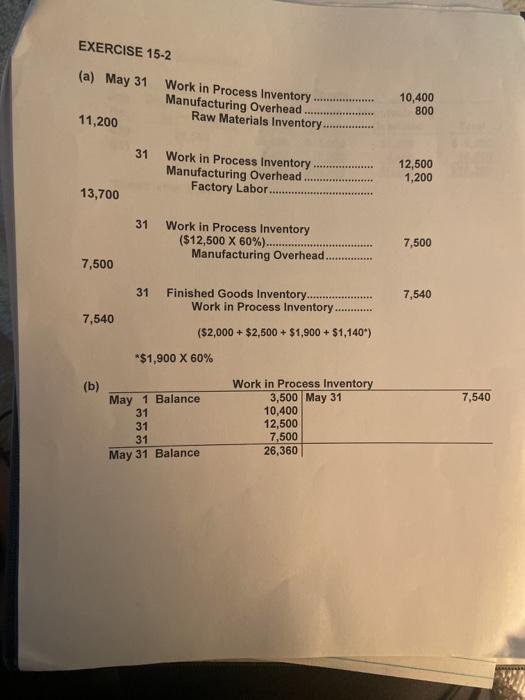

Question: EXERCISE 15-2 (a) May 31 Work in Process Inventory Manufacturing Overhead. Raw Materials Inventory 10,400 800 11,200 31 Work in Process Inventory Manufacturing Overhead Factory

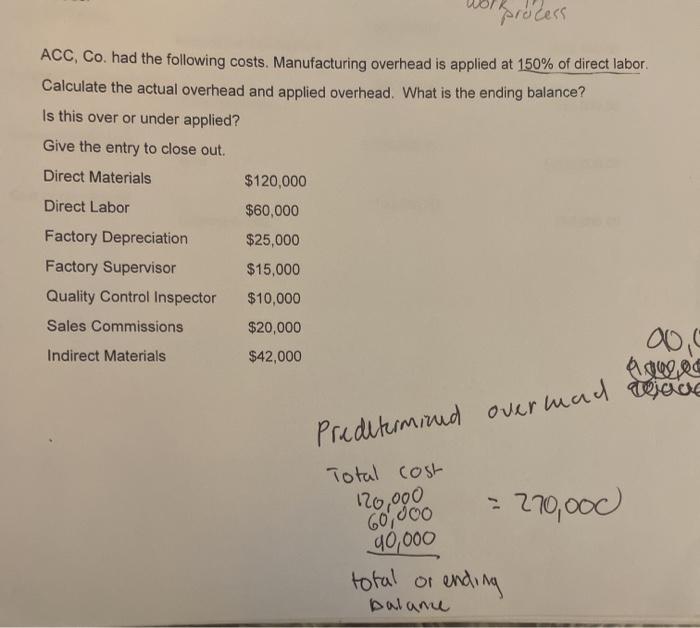

EXERCISE 15-2 (a) May 31 Work in Process Inventory Manufacturing Overhead. Raw Materials Inventory 10,400 800 11,200 31 Work in Process Inventory Manufacturing Overhead Factory Labor 12,500 1,200 13,700 31 Work in Process Inventory ($12,500 X 60%).. Manufacturing Overhead. 7,500 7,500 7,540 31 Finished Goods Inventory.. Work in Process Inventory. 7,540 ($2,000 + $2,500 + $1,900 + $1,140) *$1,900 X 60% (b) Work in Process Inventory May 1 Balance 3,500 May 31 31 10,400 31 12,500 31 7,500 May 31 Balance 26,360 7,540 process ACC, Co. had the following costs. Manufacturing overhead is applied at 150% of direct labor Calculate the actual overhead and applied overhead. What is the ending balance? Is this over or under applied? Give the entry to close out. Direct Materials $120,000 Direct Labor $60,000 $25,000 $15,000 Factory Depreciation Factory Supervisor Quality Control Inspector Sales Commissions Indirect Materials $10,000 $20,000 $42.000 00,0 A good Predetermand overmad aloue Total cost 120,000 = 270,000 60,000 40,000 total or ending balame

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts