Question: Exercise 1521 (Algorithmic) (LO. 3, 4) In 2021, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding customers using various platforms like

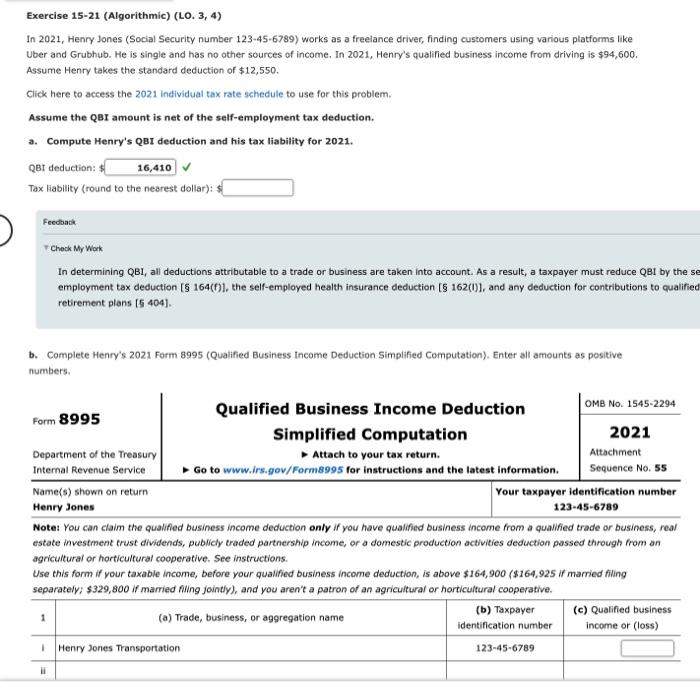

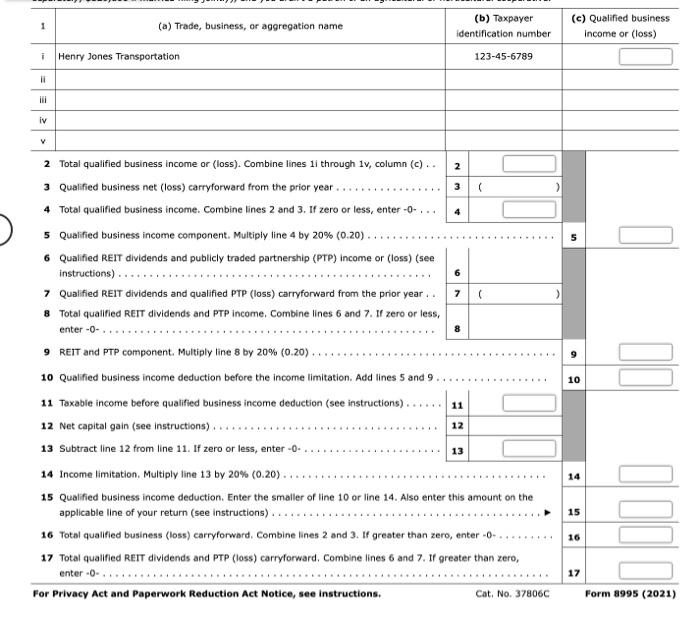

Exercise 1521 (Algorithmic) (LO. 3, 4) In 2021, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding customers using various platforms like Uber and Grubhub. He is single and has no other sources of income, In 2021, Henry's qualified business income from driving is $94,600. Assume Henry takes the standard deduction of $12,550. Click here to access the 2021 individual tax rate schedule to use for this problem. Assume the QBI amount is net of the self-employment tax deduction. a. Compute Henry's QBI deduction and his tax liability for 2021. QB1 deduction: 5 Tax liability (round to the nearest dollar): $ Fecoback Check My Work In determining QBI, all deductions attributable to a trade or business are taken into account, As a result, a taxpayer must reduce QBI by the s employment tax deduction [ 5164(f) ]. the self-employed health insurance deduction [5 162(I)], and any deduction for contributions to qualifie retirement plans [5404]. b. Complete Henry's 2021 Form 8995 (Qualified Business income Deduction Simplified Computation). Enter all amounts as positive numbers. \begin{tabular}{c|c|c|c} \hline 1 & (a) Trade, business, or aggregation name & (b) Taxpayer Qualified business income or (loss) \\ \hline i & Henry Jones Transportation & \\ \hline ii & & 123456789 \\ \hline iii & & \\ \hline iv & & \\ \hlinev & & \\ \hline \end{tabular} 2 Total qualified business income or (loss). Combine lines 1 i through 1v, column (c).. 3 Qualified business net (loss) carryforward from the prior year 4 Total qualified business income. Combine lines 2 and 3 . If zero or less, enter 0.,4 5 Qualified business income component. Multiply line 4 by 20%(0.20). 6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions) 7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior year . 8 Total qualified REIT dividends and PTP income, Combine lines 6 and 7. If zero or less, enter-0- 9 REIT and PTP component. Multiply line 8 by 20%(0.20). 11 Taxable income before qualified business income deduction (see instructions) 12 Net capital gain (see instructions) 13 Subtract line 12 from line 11 . If zero or less, enter 013 15 Qualified business income deduction. Enter the smaller of line 10 or line 14. Also enter this amount on the applicable line of your return (see instructions) 16 Total qualified business (loss) carryforward. Combine lines 2 and 3 . If greater than zero, enter-0- 17 Total qualified REIT dividends and PTP (loss) carryforward, Combine lines 6 and 7. If greater than zero, enter =0 - 17 For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat, No. 37806C Form 8995 (2021)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts