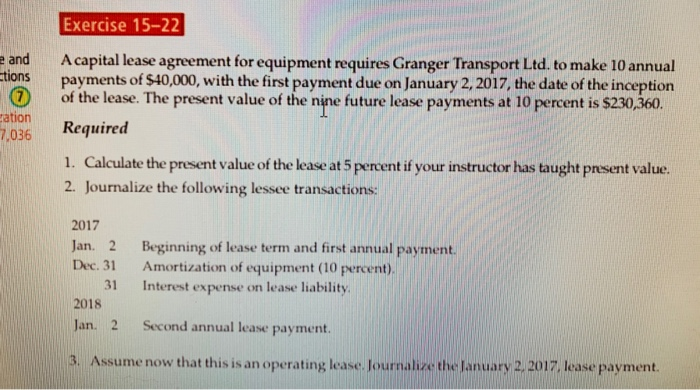

Question: Exercise 15-22 e and tions @ ration 7,036 A capital lease agreement for equipment requires Granger Transport Ltd. to make 10 annual payments of $40,000,

Exercise 15-22 e and tions @ ration 7,036 A capital lease agreement for equipment requires Granger Transport Ltd. to make 10 annual payments of $40,000, with the first payment due on January 2, 2017, the date of the inception of the lease. The present value of the nine future lease payments at 10 percent is $230,360. Required 1. Calculate the present value of the lease at 5 percent if your instructor has taught present value. 2. Journalize the following lessee transactions: 2017 Jan. 2 Dec. 31 31 2018 Jan. 2 Beginning of lease term and first annual payment. Amortization of equipment (10 percent), Interest expense on lease liability Second annual lease payment. 3. Assume now that this is an operating lease. Journalize the lanuary 2, 2017, lease payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts