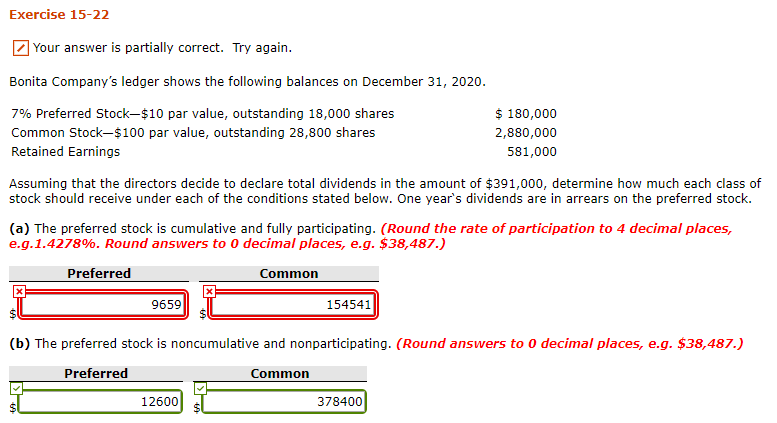

Question: Exercise 15-22 your answer is partially correct. Try again. Bonita Company's ledger shows the following balances on December 31, 2020. 7% Preferred Stock-$10 par value,

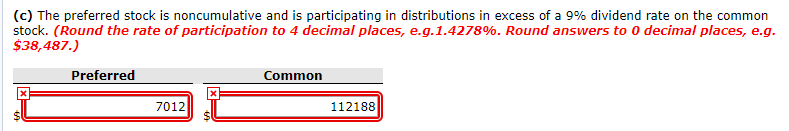

Exercise 15-22 your answer is partially correct. Try again. Bonita Company's ledger shows the following balances on December 31, 2020. 7% Preferred Stock-$10 par value, outstanding 18,000 shares $ 180,000 Common Stock-$100 par value, outstanding 28,800 shares 2,880,000 Retained Earnings 581,000 Assuming that the directors decide to declare total dividends in the amount of $391,000, determine how much each class of stock should receive under each of the conditions stated below. One year's dividends are in arrears on the preferred stock. (a) The preferred stock is cumulative and fully participating. (Round the rate of participation to 4 decimal places, e.g.1.4278%. Round answers to 0 decimal places, e.g. $38,487.) Preferred Common x 9659 154541 (b) The preferred stock is noncumulative and nonparticipating. (Round answers to 0 decimal places, e.g. $38,487.) Preferred Common 12600 378400 (c) The preferred stock is noncumulative and is participating in distributions in excess of a 9% dividend rate on the common stock. (Round the rate of participation to 4 decimal places, e.g.1.4278%. Round answers to 0 decimal places, e.g. $38,487.) Preferred Common 7012 112188

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts