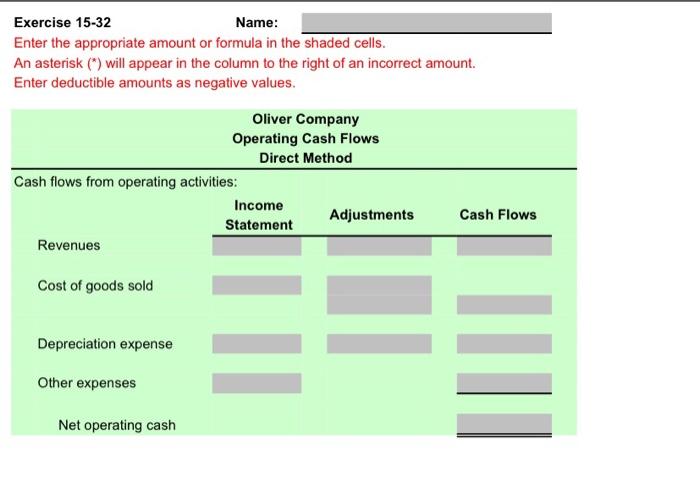

Question: Exercise 15-32 Name: Enter the appropriate amount or formula in the shaded cells. An asterisk (*) will appear in the column to the right of

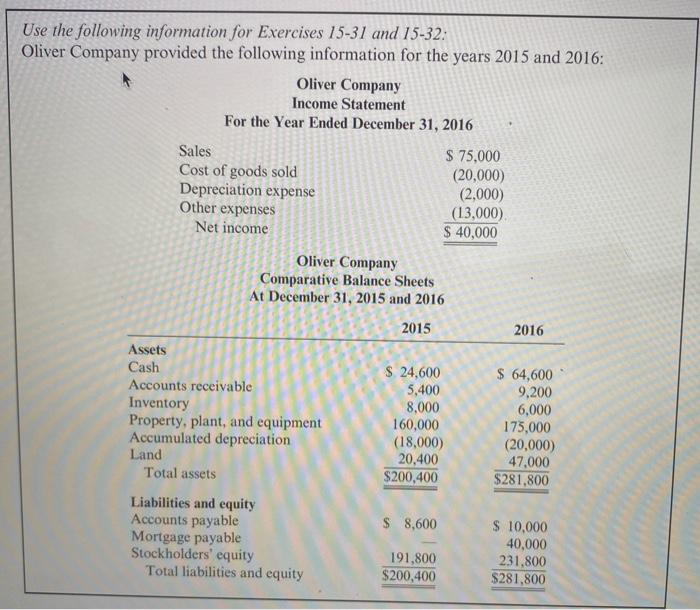

Exercise 15-32 Name: Enter the appropriate amount or formula in the shaded cells. An asterisk (*) will appear in the column to the right of an incorrect amount. Enter deductible amounts as negative values. Oliver Company Operating Cash Flows Direct Method Cash flows from operating activities: Income Statement Adjustments Cash Flows Revenues Cost of goods sold Depreciation expense Other expenses Net operating cash Use the following information for Exercises 15-31 and 15-32: Oliver Company provided the following information for the years 2015 and 2016: Oliver Company Income Statement For the Year Ended December 31, 2016 Sales $ 75,000 Cost of goods sold (20,000) Depreciation expense (2,000) Other expenses (13,000) Net income $ 40,000 Oliver Company Comparative Balance Sheets At December 31, 2015 and 2016 2015 2016 Assets Cash $ 24,600 $ 64,600 Accounts receivable 5,400 9,200 Inventory 8,000 6,000 Property, plant, and equipment 160,000 175,000 Accumulated depreciation (18,000) (20,000) Land 20,400 47.000 Total assets $200,400 $281.800 Liabilities and equity Accounts payable $ 8,600 $ 10,000 Mortgage payable 40,000 Stockholders' equity 191,800 231,800 Total liabilities and equity $200,400 $281.800 OBJECTIVE 3 Exercise 15-32 Operating Cash Flows Refer to the information for Oliver Company on the previous page. Required: Prepare a schedule that provides operating cash flows for the year 2016 using the direct method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts