Question: EXERCISE 15A, PROBLEM 27A & PROBLEM 30A Exercise 11-15A Accounting for stock dividends Beacon Corporation issued a 5 percent stock dividend on 30,000 shares of

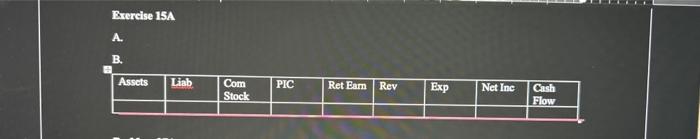

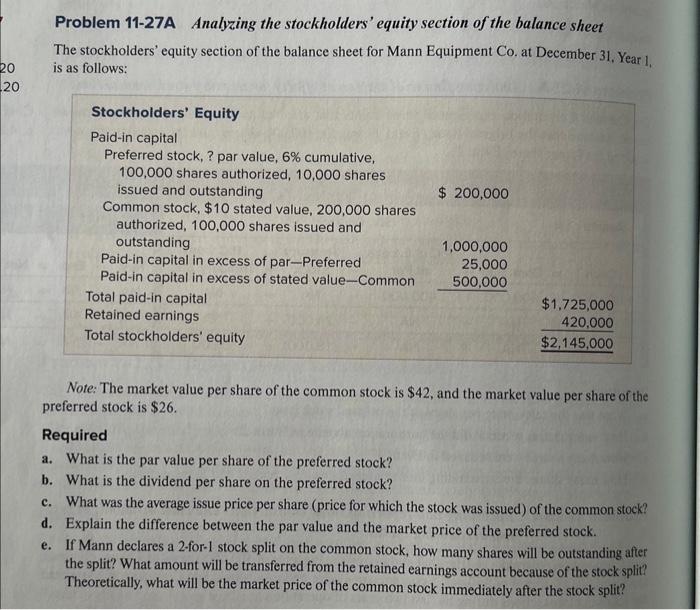

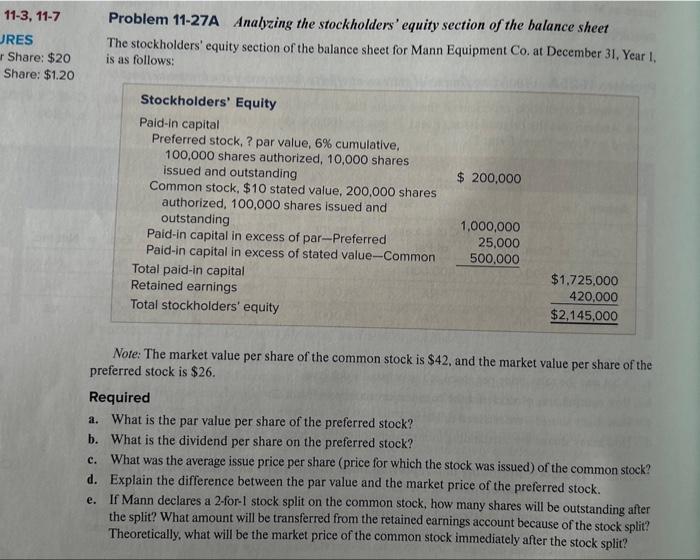

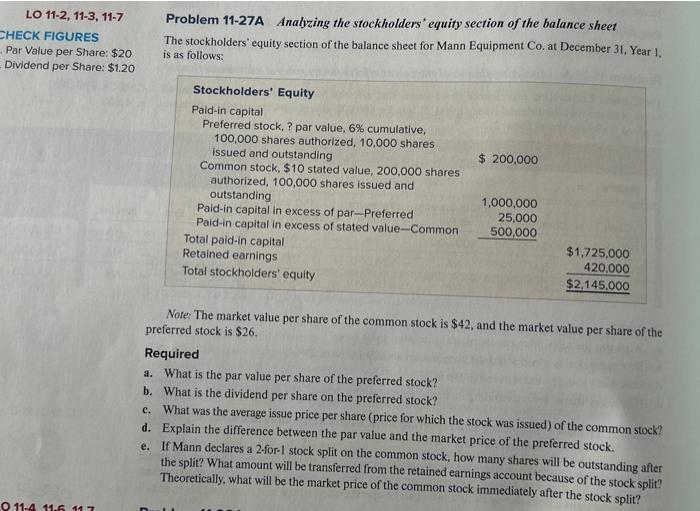

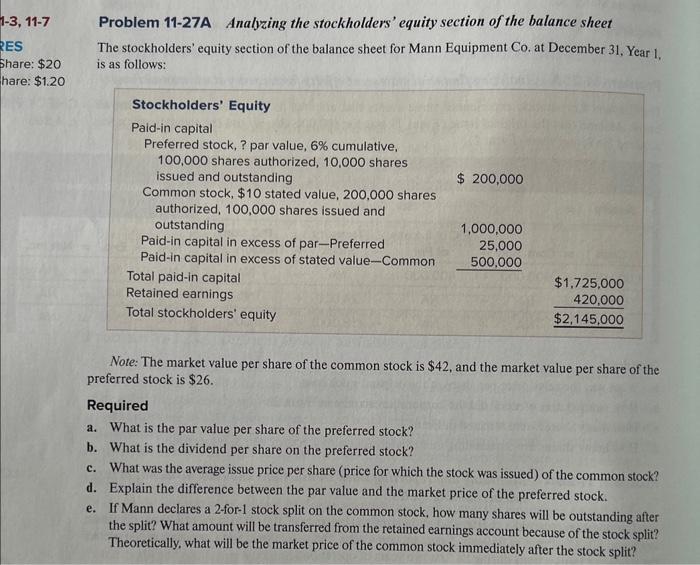

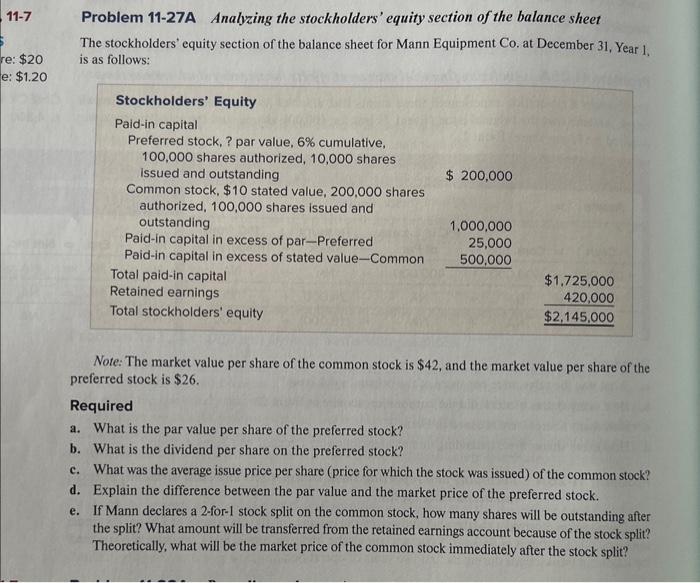

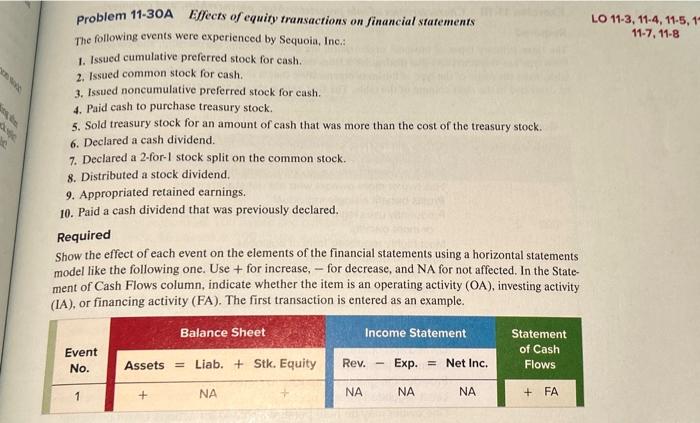

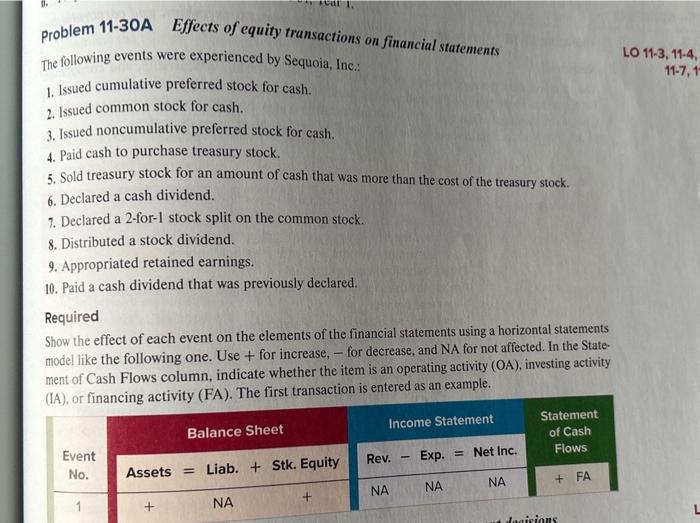

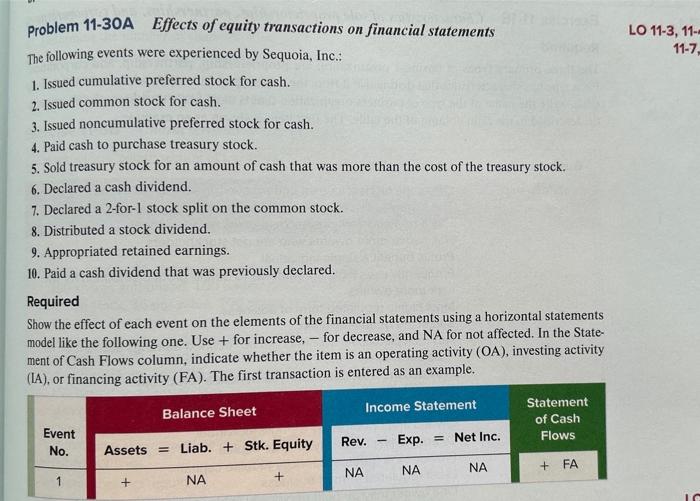

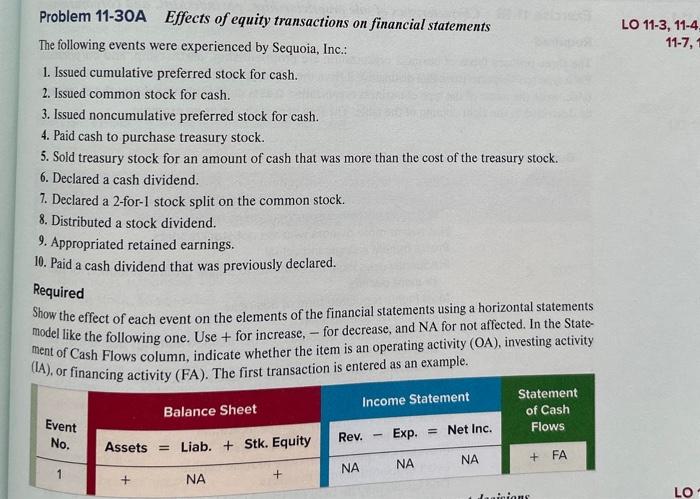

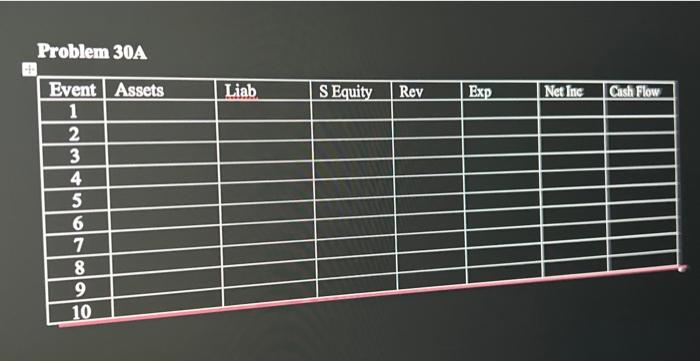

Exercise 11-15A Accounting for stock dividends Beacon Corporation issued a 5 percent stock dividend on 30,000 shares of its $10 par comanoin stock. At the time of the dividend, the market value of the stock was $15 per share. Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal stitereets model like the following one: Exercise 11-15A Accounting for stock dividends Beacon Corporation issued a 5 pereent stock dividend on 30.000 shares of its $10 par common stoci. At the time of the dividend, the market value of the stock was $15 per share. Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statemens model like the following one: Exercise 11-15A Accounting for stock dividends Beacon Corporation issued a 5 percent stock dividend on 30,000 shares of its $10 par common stock. At the time of the dividend, the market value of the stock was $15 per share. Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model like the following one: Exercise 11-15A Accounting for stock dividends Beacon Corporation issued a 5 percent stock dividend on 30.000 shares of its $10 par common stock. At the time of the dividend, the market value of the stock was $15 per share. Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model like the following one: Brereise 15A A. B. \begin{tabular}{|l|l|l|l|l|l|l|l|l|} \hline Assets & Liab & ComStock & PIC & Ret Eam & Rev & Exp & Net Ine & CashElow \\ \hline & & & & & & & & \\ \hline \end{tabular} Bxereise 15A A. B. \begin{tabular}{|l|l|l|l|l|l|l|l|l|} \hline Assets & Liab & ComStock & PIC & Ret Eam & Rev & Exp & Net Ine & CashFlow \\ \hline & & & & & & & & \\ \hline \end{tabular} Problem 11-27A Analyzing the stockholders' equity section of the balance sheet The stockholders' equity section of the balance sheet for Mann Equipment Co. at December 31, Year 1, is as follows: Note: The market value per share of the common stock is $42, and the market value per share of the preferred stock is $26. Required a. What is the par value per share of the preferred stock? b. What is the dividend per share on the preferred stock? c. What was the average issue price per share (price for which the stock was issued) of the common stock? d. Explain the difference between the par value and the market price of the preferred stock. e. If Mann declares a 2-for-1 stock split on the common stock, how many shares will be outstanding after the split? What amount will be transferred from the retained earnings account because of the stock split? Theoretically, what will be the market price of the common stock immediately after the stock split? 11-3,11-7 Problem 11-27A Analyzing the stockholders' equity section of the balance sheet Thes stockholders' equity section of the balance sheet for Mann Equipment Co. at December 31 , Year I, r Share: $20 is as follows: Share: $1.20 Note: The market value per share of the common stock is $42, and the market value per share of the preferred stock is $26. Required a. What is the par value per share of the preferred stock? b. What is the dividend per share on the preferred stock? c. What was the average issue price per share (price for which the stock was issued) of the common stock? d. Explain the difference between the par value and the market price of the preferred stock. e. If Mann declares a 2-for-1 stock split on the common stock, how many shares will be outstanding after the split? What amount will be transferred from the retained earnings account because of the stock split? Theoretically, what will be the market price of the common stock immediately after the stock split? Lo 11-2, 11-3,11-7 Problem 11-27A Analyzing the stockholders' equity section of the balance sheet CHECK FIGURES The stockholders' equity section of the balance sheet for Mann Equipment Co. at December 31 , Year 1, Par Value per Share: $20 is as follows: Dividend per Share: $1.20 Note: The market value per share of the common stock is $42, and the market value per share of the preferred stock is $26. Required a. What is the par value per share of the preferred stock? b. What is the dividend per share on the preferred stock? c. What was the average issue price per share (price for which the stock was issued) of the common stock? d. Explain the difference between the par value and the market price of the preferred stock. e. If Mann declares a 2 -for-1 stock split on the common stock, how many shares will be outstanding after the split? What amount will be transferred from the retained earnings account because of the stock split? Theoretically, what will be the market price of the common stock immediately after the stock split? 1-3,11-7 Problem 11-27A Analyzing the stockholders' equity section of the balance sheet The stockholders' equity section of the balance sheet for Mann Equipment Co. at December 31, Year 1 , is as follows: hare: $1.20 Note: The market value per share of the common stock is $42, and the market value per share of the preferred stock is $26. Required a. What is the par value per share of the preferred stock? b. What is the dividend per share on the preferred stock? c. What was the average issue price per share (price for which the stock was issued) of the common stock? d. Explain the difference between the par value and the market price of the preferred stock. e. If Mann declares a 2 -for-1 stock split on the common stock, how many shares will be outstanding after the split? What amount will be transferred from the retained earnings account because of the stock split? Theoretically, what will be the market price of the common stock immediately after the stock split? Problem 11-27A Analyzing the stockholders'equity section of the balance sheet The stockholders' equity section of the balance sheet for Mann Equipment Co. at December 31, Year 1, is as follows: Note: The market value per share of the common stock is $42, and the market value per share of the preferred stock is $26. Required a. What is the par value per share of the preferred stock? b. What is the dividend per share on the preferred stock? c. What was the average issue price per share (price for which the stock was issued) of the common stock? d. Explain the difference between the par value and the market price of the preferred stock. e. If Mann declares a 2-for-1 stock split on the common stock, how many shares will be outstanding after the split? What amount will be transferred from the retained earnings account because of the stock split? Theoretically, what will be the market price of the common stock immediately after the stock split? Problem 27 A A. B. C. D. E. 1.\# shares outstanding: 2. Transferred: 3. Market Price: Problem 27A A. B. C. D. E. 1. \# shares outstanding: 2. Transferred: 3. Market Price: Problem 11-30A Effects of equity transactions on financial statements The following events were experienced by Sequoia, Ine.: 1. Issued cumulative preferred stock for cash. 2. Issued common stock for cash. 3. Issued noncumulative preferred stock for eash. 4. Paid eash to purchase treasury stock. 5. Sold treasury stock for an amount of cash that was more than the cost of the treasury stock. 6. Declared a cash dividend. 7. Declared a 2-for-1 stock split on the common stock. 8. Distributed a stock dividend. 9. Appropriated retained earnings. 10. Paid a cash dividend that was previously declared. Required Show the effect of each event on the elements of the financial statements using a horizontal stateme model like the following one. Use + for increase, - for decrease, and NA for not affected. In the St: ment of Cash Flows column, indicate whether the item is an operating activity (OA), investing activ IA), or financing activity (FA). The first transaction is entered as an example. problem 11-30A Effects of equity transactions on financial statements The following events were experienced by Sequoia, Inc:: 1. Issued cumulative preferred stock for cash. 2. Issued common stock for cash. 3. Issued noncumulative preferred stock for cash. 4. Paid cash to purchase treasury stock. 5. Sold treasury stock for an amount of cash that was more than the cost of the treasury stock. 6. Declared a cash dividend. 7. Declared a 2 -for-1 stock split on the common stock. 8. Distributed a stock dividend. 9. Appropriated retained earnings. 10. Paid a cash dividend that was previously declared. Required Show the effect of each event on the elements of the financial statements using a horizontal statements model like the following one. Use + for increase, - for decrease, and NA for not affected. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA) or financing activity (FA). The first transaction is entered as an example. Problem 11-30A Effects of equity transactions on financial statements The following events were experienced by Sequoia, Inc.: 1. Issued cumulative preferred stock for cash. 2. Issued common stock for cash. 3. Issued noncumulative preferred stock for cash. 4. Paid cash to purchase treasury stock. 5. Sold treasury stock for an amount of cash that was more than the cost of the treasury stock. 6. Declared a cash dividend. 7. Declared a 2 -for-1 stock split on the common stock. 8. Distributed a stock dividend. 9. Appropriated retained earnings. 10. Paid a cash dividend that was previously declared. Required Show the effect of each event on the elements of the financial statements using a horizontal statements model like the following one. Use + for increase, - for decrease, and NA for not affected. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). The first transaction is entered as an example. Problem 11-30A Effects of equity transactions on financial statements The following events were experienced by Sequoia, Inc.: 1. Issued cumulative preferred stock for cash. 2. Issued common stock for cash. 3. Issued noncumulative preferred stock for cash. 4. Paid cash to purchase treasury stock. 5. Sold treasury stock for an amount of cash that was more than the cost of the treasury stock. 6. Declared a cash dividend. 7. Declared a 2 -for-1 stock split on the common stock. 8. Distributed a stock dividend. 9. Appropriated retained earnings. 10. Paid a cash dividend that was previously declared. Required Show the effect of each event on the elements of the financial statements using a horizontal statements model like the following one. Use + for increase, - for decrease, and NA for not affected. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activitv (FA). The first transaction is entered as an example. Problem 30A Problem 30A \begin{tabular}{|c|l|l|l|l|l|l|l|} \hline Event & Assets & Liab & S Equity & Rev & Exp & Net Inc & Cash Flow \\ \hline 1 & & & & & & & \\ \hline 2 & & & & & & & \\ \hline 3 & & & & & & & \\ \hline 4 & & & & & & & \\ \hline 5 & & & & & & & \\ \hline 6 & & & & & & & \\ \hline 7 & & & & & & & \\ \hline 8 & & & & & & & \\ \hline 9 & & & & & & & \\ \hline 10 & & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Lets break down each part of the exercises Exercise 1115A Accounting for Stock Dividends a Compute the amount of the stock dividend 1 Total Shares Out... View full answer

Get step-by-step solutions from verified subject matter experts