Question: Exercise 1.6 Suppose that A(0) = 100 and A(1) = 105 dollars, the present price of pound sterling is S(0) = 1.6 dollars, and the

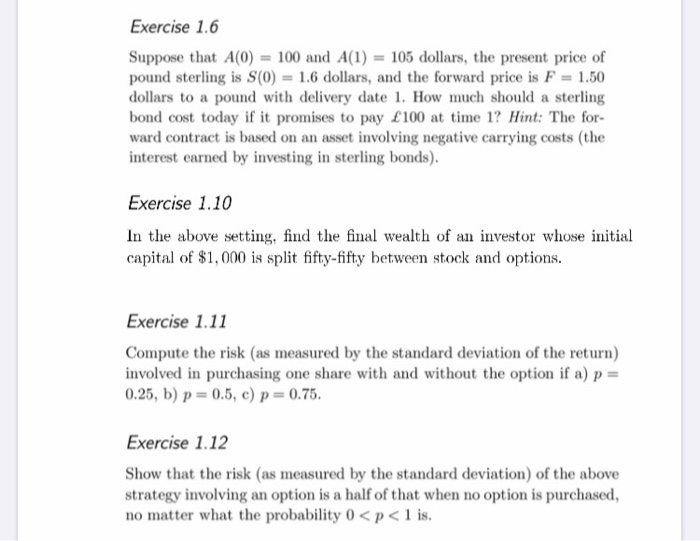

Exercise 1.6 Suppose that A(0) = 100 and A(1) = 105 dollars, the present price of pound sterling is S(0) = 1.6 dollars, and the forward price is F = 1.50 dollars to a pound with delivery date 1. How much should a sterling bond cost today if it promises to pay 100 at time 1? Hint: The for- ward contract is based on an asset involving negative carrying costs (the interest earned by investing in sterling bonds). Exercise 1.10 In the above setting, find the final wealth of an investor whose initial capital of $1,000 is split fifty-fifty between stock and options. Exercise 1.11 Compute the risk (as measured by the standard deviation of the return) involved in purchasing one share with and without the option if a) p = 0.25, b) p = 0.5, c) p = 0.75. Exercise 1.12 Show that the risk (as measured by the standard deviation) of the above strategy involving an option is a half of that when no option is purchased, no matter what the probability 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts