Question: Exercise 16-16 (Algo) Multiple differences; financial statement effects [LO16-2, 16-3, 16-5] For the year ended December 31, 2024, Fidelity Engineering reported pretax accounting income of

![Exercise 16-16 (Algo) Multiple differences; financial statement effects [LO16-2, 16-3, 16-5]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e98de85e2d0_24766e98de7ebf0d.jpg)

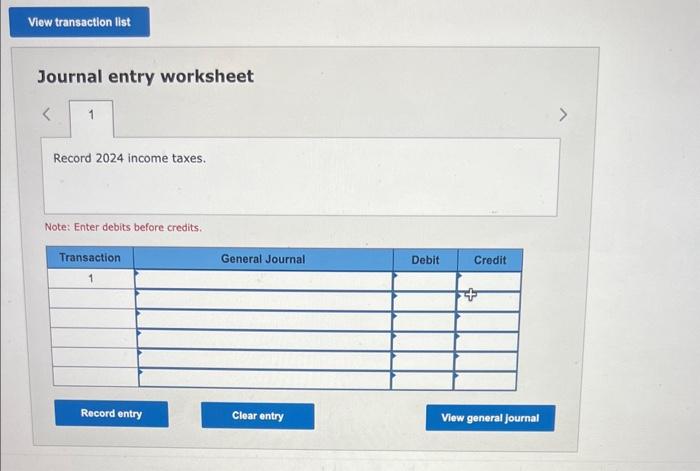

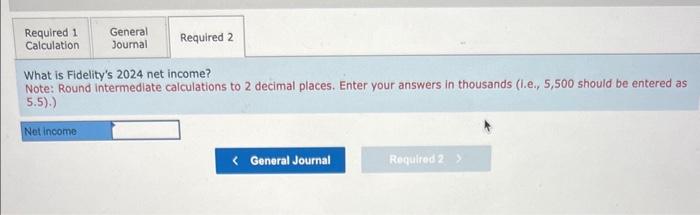

Exercise 16-16 (Algo) Multiple differences; financial statement effects [LO16-2, 16-3, 16-5] For the year ended December 31, 2024, Fidelity Engineering reported pretax accounting income of $1,044,000. Selected information for 2024 from Fidelity's records follows: Interent income on municipal governmental bonds Depreciation elaimed on the 2024 tax return in excess of depreciation on the income statement 100,000 124,000 carrying asount of depreciable assets in excean of their tax banis at year-end Warranty expense reported on the income atatemont Actual varranty expenditures in 2024 Fidelitys income tax rate is 25%. At January 1, 2024. Fidelity's records indicated balances of zero and $25,000 in its deferred tax asset and deferred tax llability accounts, respectively. Required: 1. Determine the amounts necessary to record income taxes for 2024 , and prepare the appropriate journal entry. 2. What is Fidelity's 2024 net income? Journal entry worksheet Note: Enter debits before credits. What is Fidelity's 2024 net income? Note: Round intermedlate calculations to 2 decimal places. Enter your answers in thousands (I.e., 5,500 should be entered as 5.5).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts