Question: Exercise 16-32 (Algorithmic) (LO. 4) In 2021, Skylar sold an apartment building for $195,000 cash and a $1,950,000 note due in two years. Skylar's

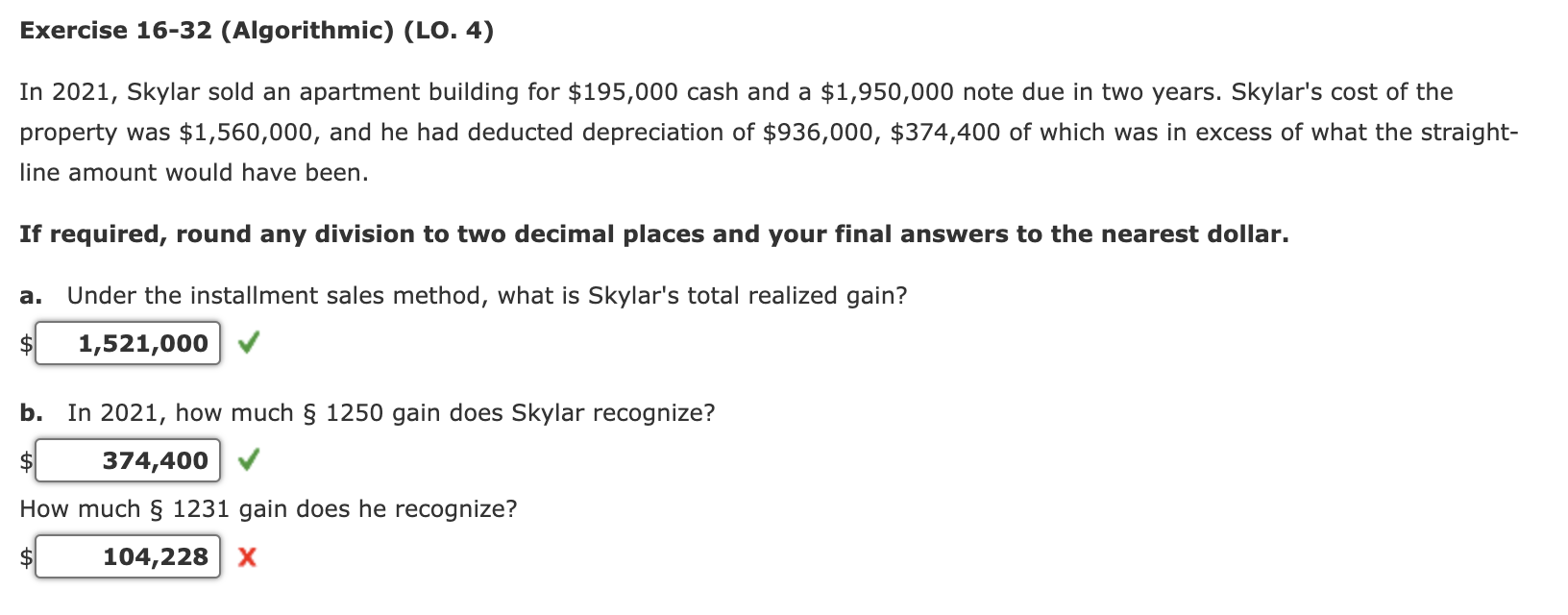

Exercise 16-32 (Algorithmic) (LO. 4) In 2021, Skylar sold an apartment building for $195,000 cash and a $1,950,000 note due in two years. Skylar's cost of the property was $1,560,000, and he had deducted depreciation of $936,000, $374,400 of which was in excess of what the straight- line amount would have been. If required, round any division to two decimal places and your final answers to the nearest dollar. Under the installment sales method, what is Skylar's total realized gain? $ 1,521,000 b. In 2021, how much 1250 gain does Skylar recognize? $ 374,400 How much 1231 gain does he recognize? $ 104,228 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts