Question: Exercise 16-36 Payback Period; Even Cash Flows (Section 3) (LO 16-1, 16-8) The following information applies to the questions displayed below.1 The management of Iroquois

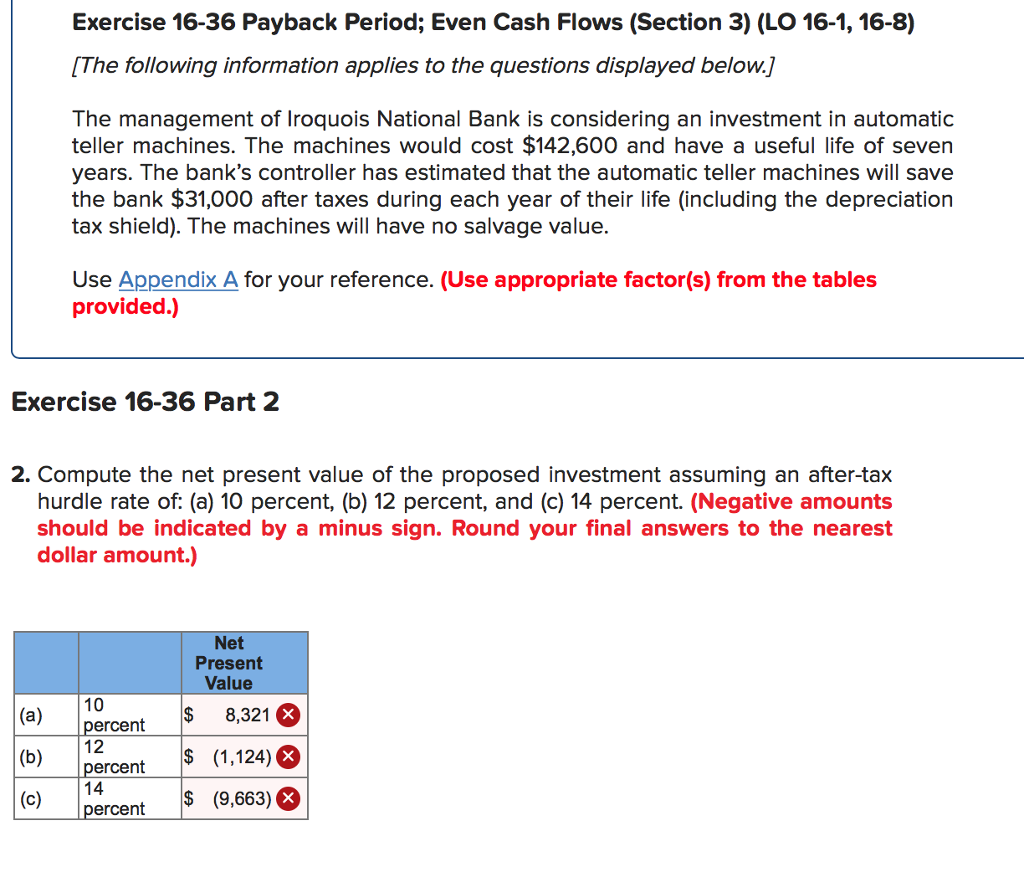

Exercise 16-36 Payback Period; Even Cash Flows (Section 3) (LO 16-1, 16-8) The following information applies to the questions displayed below.1 The management of Iroquois National Bank is considering an investment in automatic teller machines. The machines would cost $142,600 and have a useful life of seven years. The bank's controller has estimated that the automatic teller machines will save the bank $31,000 after taxes during each year of their life (including the depreciation tax shield). The machines will have no salvage value. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Exercise 16-36 Part 2 2. Compute the net present value of the proposed investment assuming an after-tax hurdle rate of: (a) 10 percent, (b) 12 percent, and (c) 14 percent. (Negative amounts should be indicated by a minus sign. Round your final answers to the nearest dollar amount.) Net Present Value $ 8,321 ercent 12 percent $ (1,124] percent (9,663) 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts