Question: Exercise 16-44 Comprehensive Cost Variance Analysis (LO 16-5, 6) NSF Lube is a fast-growing chain of oll-change stores. The following data are available for last

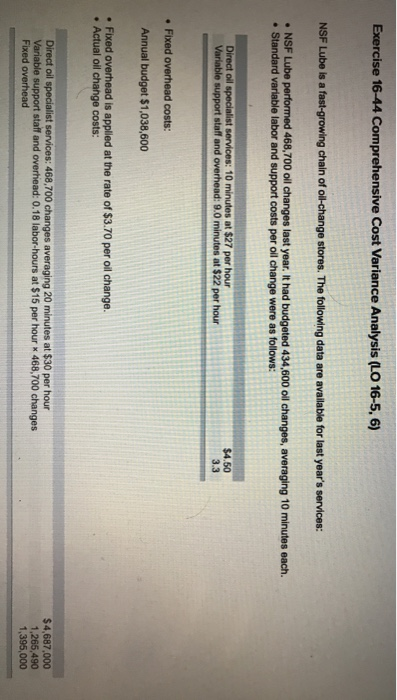

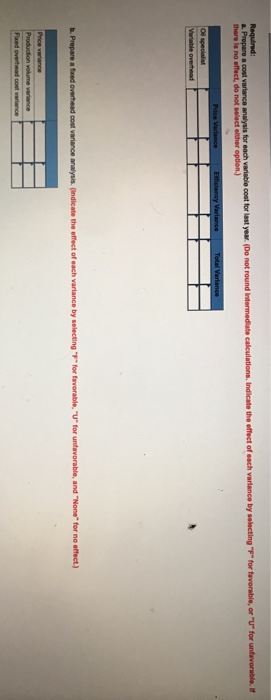

Exercise 16-44 Comprehensive Cost Variance Analysis (LO 16-5, 6) NSF Lube is a fast-growing chain of oll-change stores. The following data are available for last year's services: NSF Lube performed 468,700 oil changes last year. It had budgeted 434,600 oil changes, averaging 10 minutes each. Standard variable labor and support costs per oil change were as follows: Direct oil specialist services: 10 minutes at $27 per hour Variable support staff and overhead: 9.0 minutes at $22 per hour $4.50 3.3 Fixed overhead costs: Annual budget $1,038,600 Fixed overhead is applied at the rate of $3.70 per oil change. Actual oil change costs: Direct oil specialist services: 468,700 changes averaging 20 minutes at $30 per hour Variable support staff and overhead: 0.18 labor hours at $15 per hour 468,700 changes Fixed overhead $4,687,000 1,265,490 1,395,000 Required: 1. Prepare a cost variance analysis for each variable cost for last year. (Do not round Intermediate calculations, indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. there is no effect, do not select other option) Price Variance Efficiency Variance Total Variance ol specialist Variable overhead b. Prepare a fixed overhead cost variance analysis indicate the effect of each variance by selecting "T" for favorable. "U" for unfavorable, and "None" for no effect.) Price variance Production volume variance Fad overhead cool variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts