Question: Exercise 17-24 (Algorithmic) (LO. 2) Crane and Loon corporations, two unrelated C corporations, have the following transactions for the current year. Crane Loon Gross income

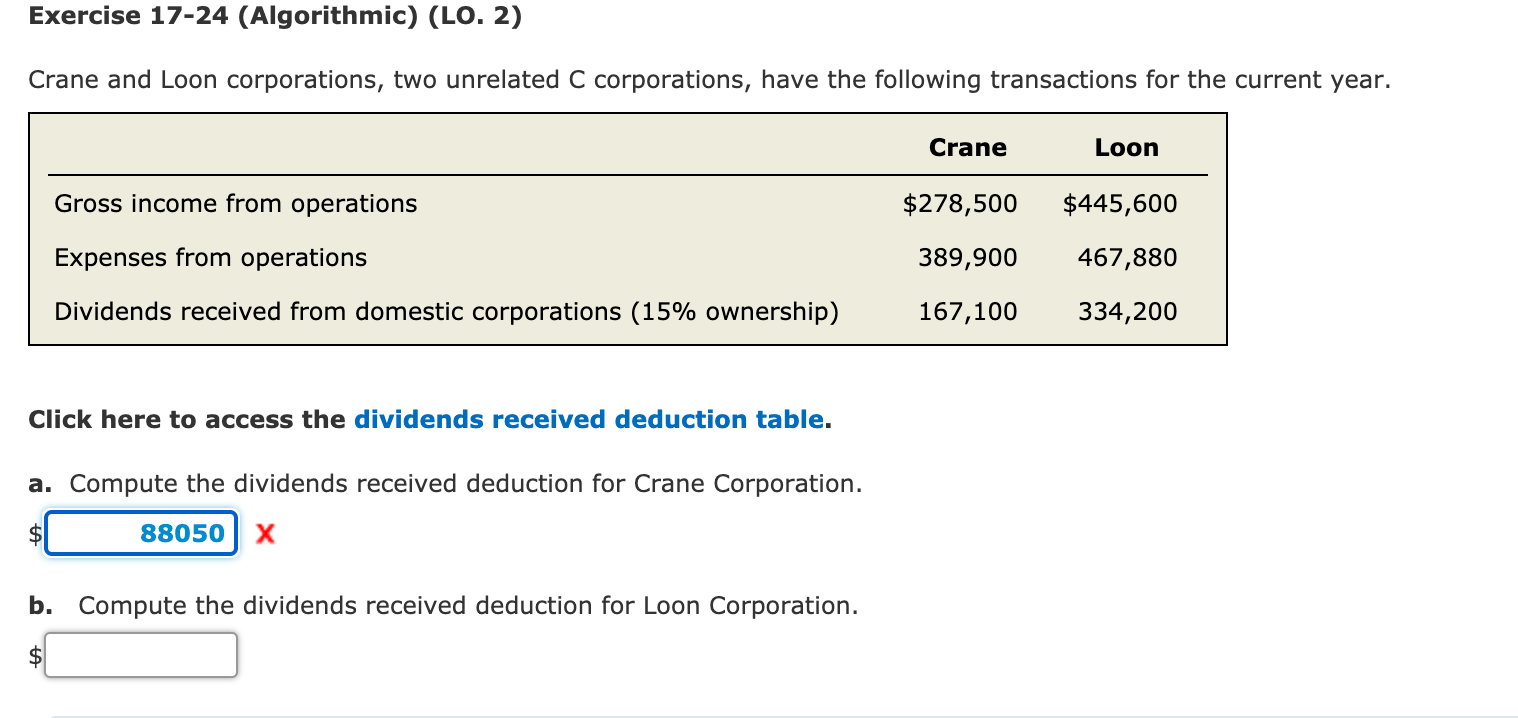

Exercise 17-24 (Algorithmic) (LO. 2) Crane and Loon corporations, two unrelated C corporations, have the following transactions for the current year. Crane Loon Gross income from operations $278,500 $445,600 Expenses from operations 389,900 467,880 Dividends received from domestic corporations (15% ownership) 167,100 334,200 Click here to access the dividends received deduction table. a. Compute the dividends received deduction for Crane Corporation. $ 88050 b. Compute the dividends received deduction for Loon Corporation. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts