Question: Exercise 18-25 (Algo) Computing and analyzing operating leverage LO A2 Hudson Company reports the following contribution margin income statement. 1. Compute the company's degree of

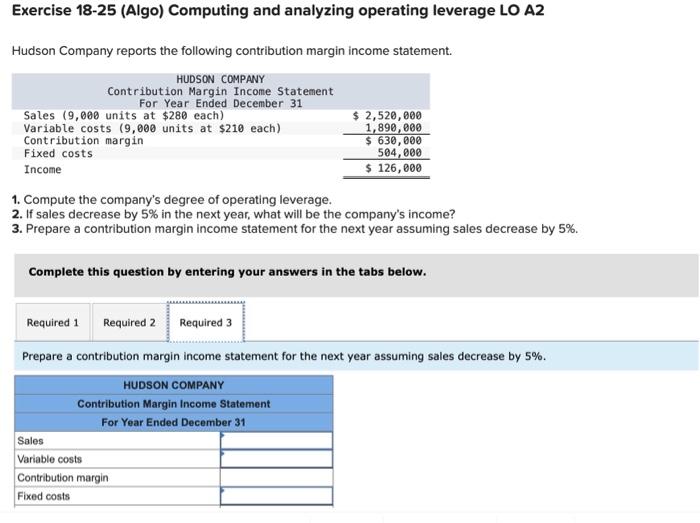

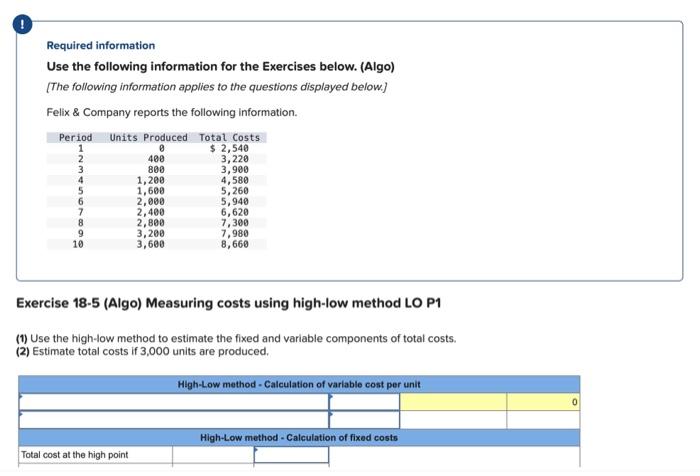

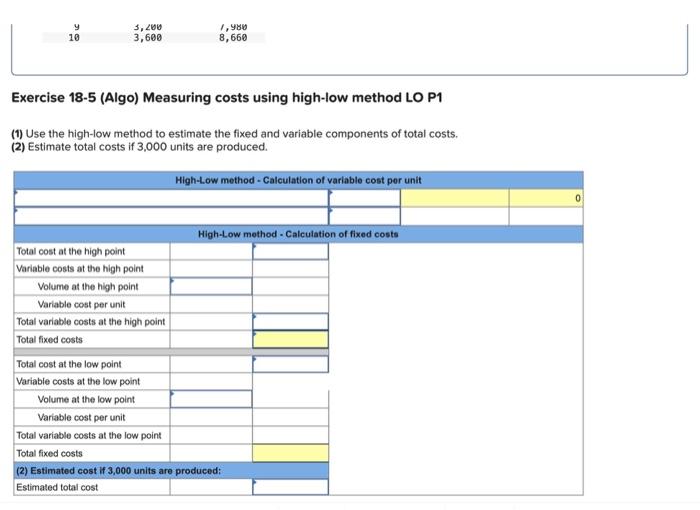

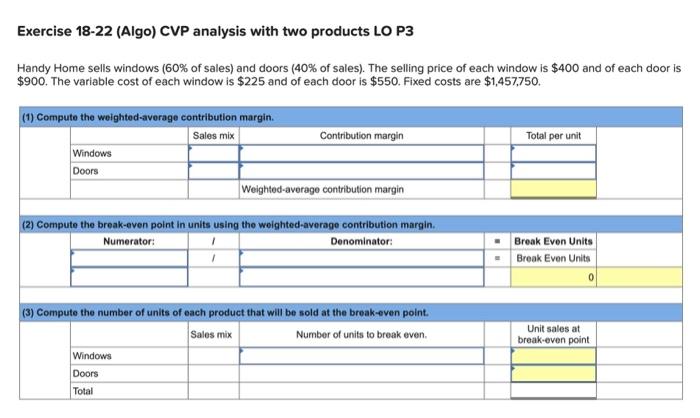

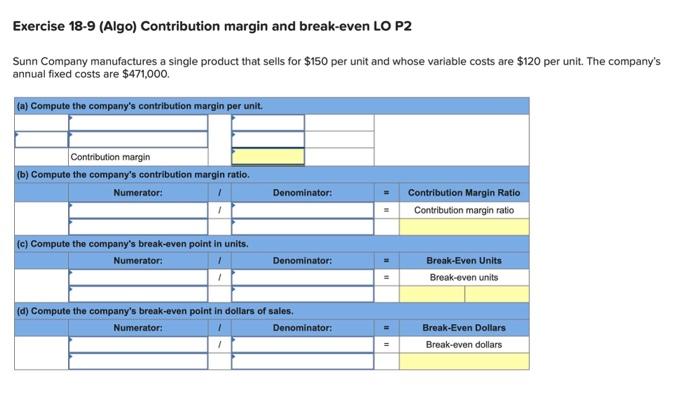

Exercise 18-25 (Algo) Computing and analyzing operating leverage LO A2 Hudson Company reports the following contribution margin income statement. 1. Compute the company's degree of operating leverage. 2. If sales decrease by 5% in the next year, what will be the company's income? 3. Prepare a contribution margin income statement for the next year assuming sales decrease by 5%. Complete this question by entering your answers in the tabs below. Prepare a contribution margin income statement for the next year assuming sales decrease by 5%. Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Felix \& Company reports the following information. Exercise 18-5 (Algo) Measuring costs using high-low method LO P1 (1) Use the high-low method to estimate the fixed and variable components of total costs. (2) Estimate total costs if 3,000 units are produced. Exercise 18-5 (Algo) Measuring costs using high-low method LO P1 (1) Use the high-low method to estimate the fixed and variable components of total costs. (2) Estimate total costs if 3,000 units are produced. Exercise 18-22 (Algo) CVP analysis with two products LO P3 Handy Home sells windows ( 60% of sales) and doors ( 40% of sales). The selling price of each window is $400 and of each door is $900. The variable cost of each window is $225 and of each door is $550. Fixed costs are $1,457,750. Exercise 18-9 (Algo) Contribution margin and break-even LO P2 Sunn Company manufactures a single product that sells for $150 per unit and whose variable costs are $120 per unit. The company's annual fixed costs are $471,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts