Question: Exercise 18-30 (Part Level Submission) Cheyenne Financial Services performs bookkeeping and tax-reporting services to startup companies in the Oconomowoc area. On January 1, 2017, Cheyenne

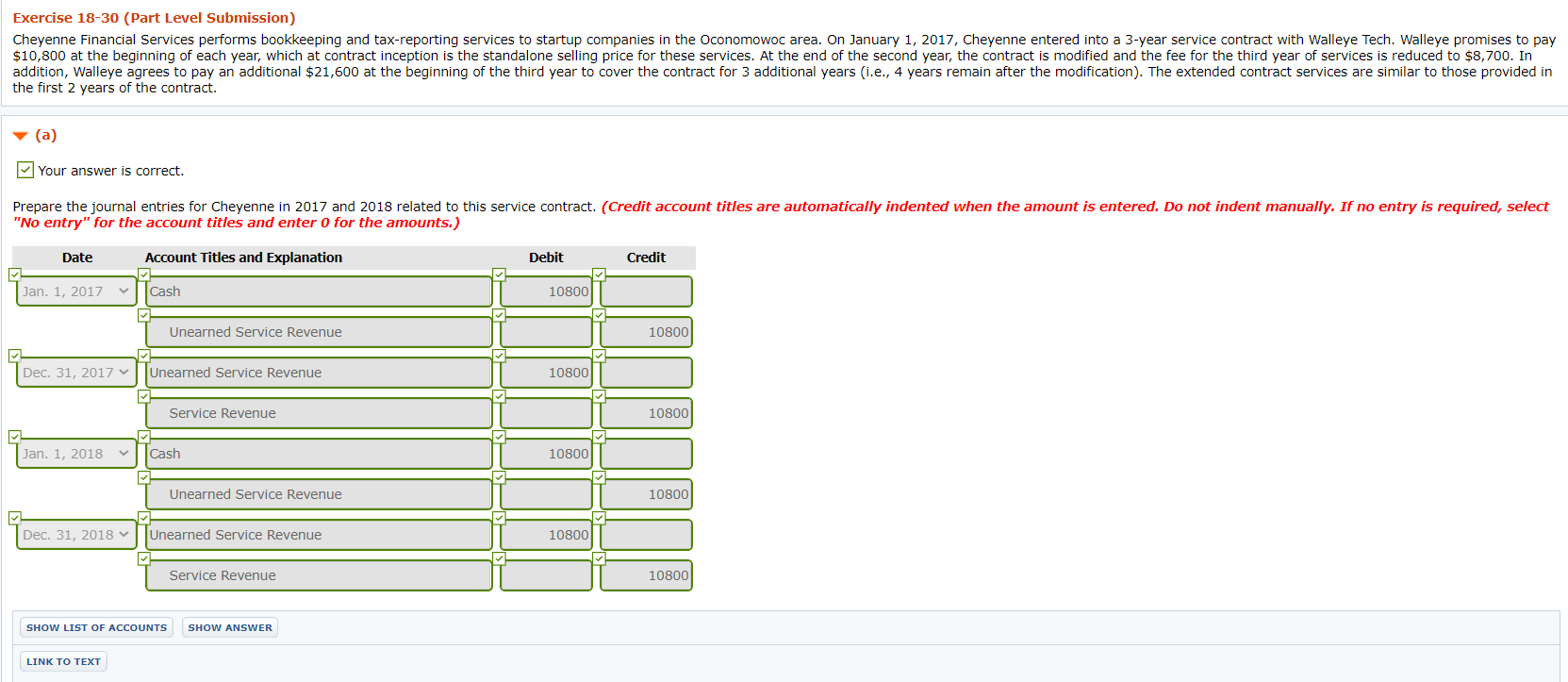

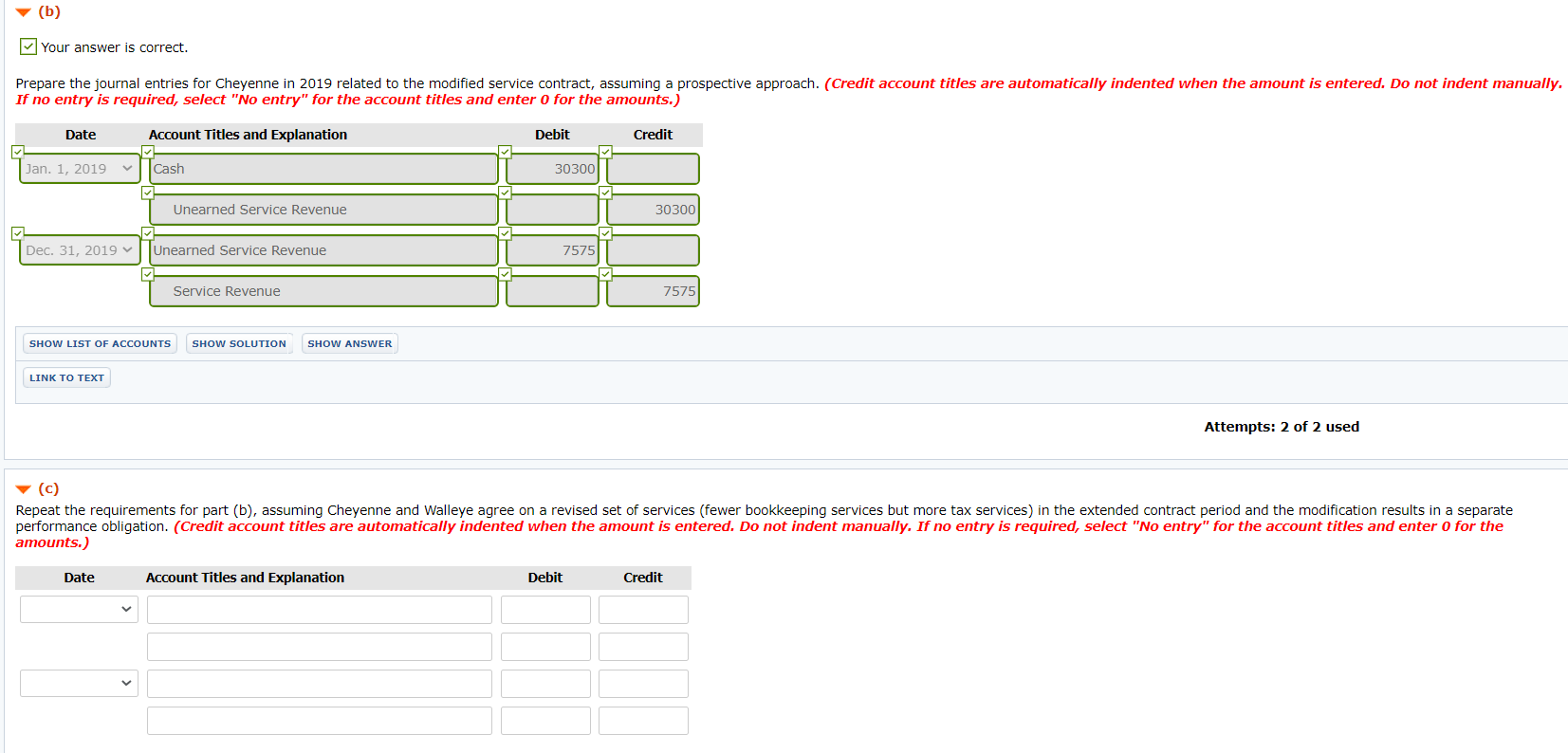

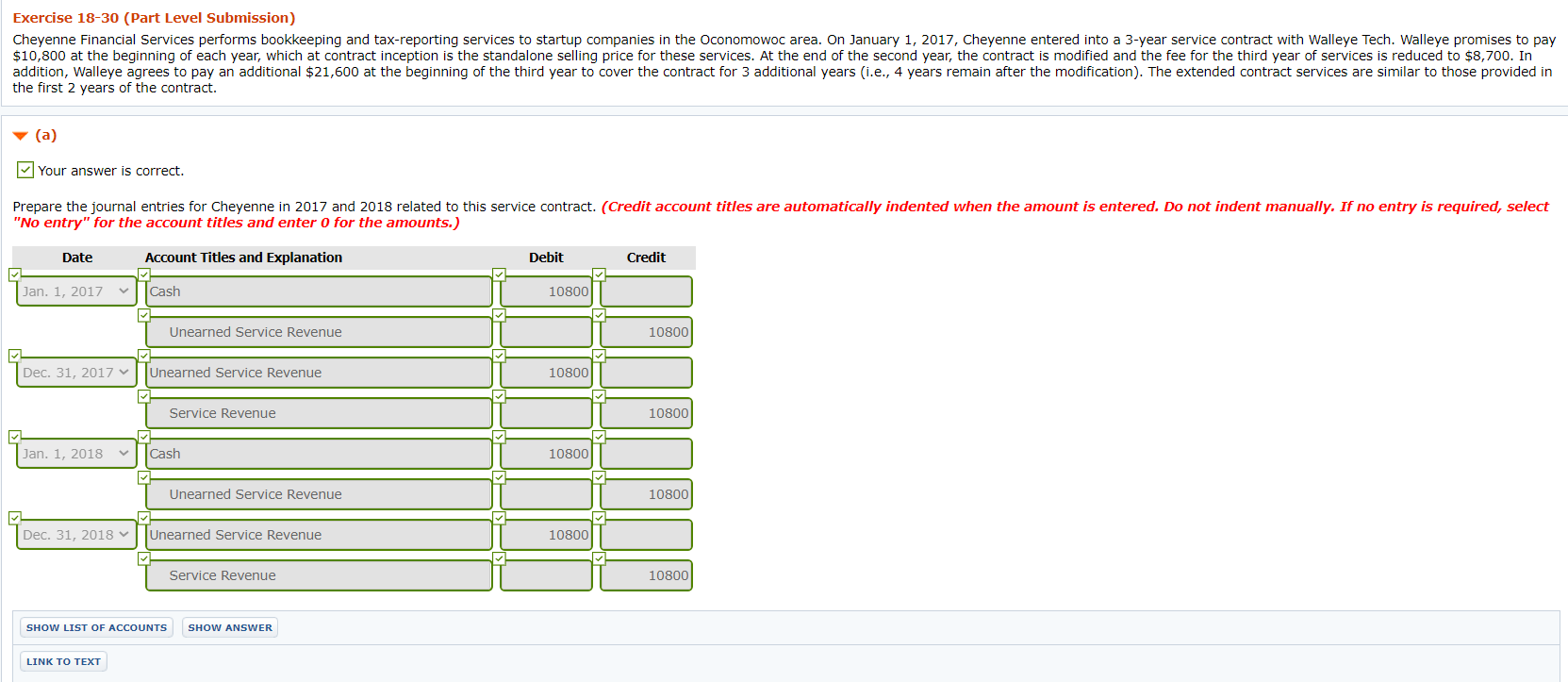

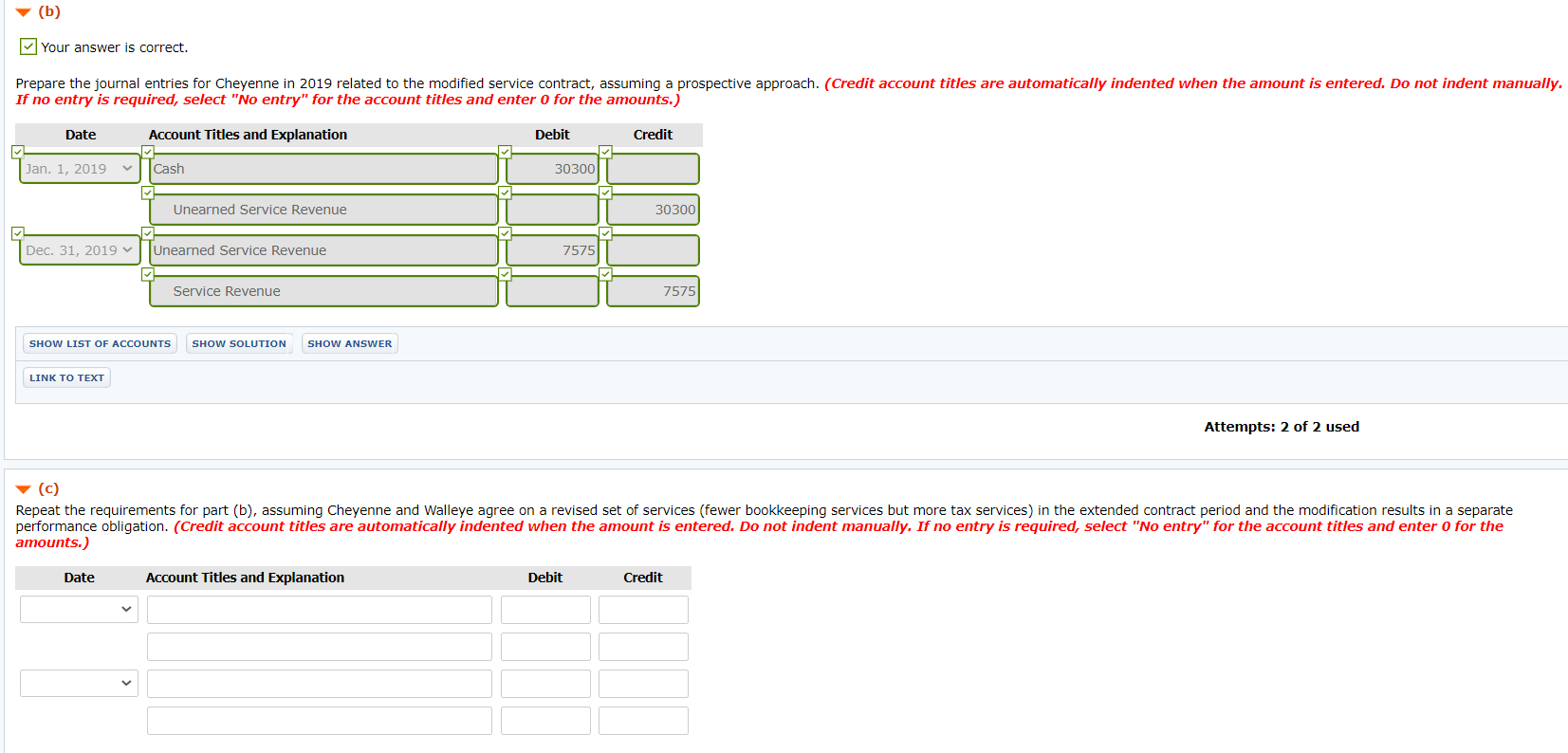

Exercise 18-30 (Part Level Submission) Cheyenne Financial Services performs bookkeeping and tax-reporting services to startup companies in the Oconomowoc area. On January 1, 2017, Cheyenne entered into a 3-year service contract with Walleye Tech. Walleye promises to pay $10,800 at the beginning of each year, which at contract inception is the standalone selling price for these services. At the end of the second year, the contract is modified and the fee for the third year of services is reduced to $8,700. In addition, Walleye agrees to pay an additional $21,600 at the beginning of the third year to cover the contract for 3 additional years (i.e., 4 years remain after the modification). The extended contract services are similar to those provided in the first 2 years of the contract. (a) Your answer is correct. Prepare the journal entries for Cheyenne in 2017 and 2018 related to this service contract. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 1, 2017 Cash 10800 Unearned Service Revenue 10800 Dec. 31, 2017 v Unearned Service Revenue 10800 Service Revenue 10800 V Jan. 1, 2018 Cash 10800 Unearned Service Revenue 10800 Dec. 31, 2018 v Unearned Service Revenue 10800 Service Revenue 10800 SHOW LIST OF ACCOUNTS SHOW ANSWER LINK TO TEXT(b) Your answer is correct. Prepare the journal entries for Cheyenne in 2019 related to the modified service contract, assuming a prospective approach. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 1, 2019 Cash 30300 Unearned Service Revenue 30300 Dec. 31, 2019 Unearned Service Revenue 7575 Service Revenue 7575 SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER LINK TO TEXT Attempts: 2 of 2 used (c) Repeat the requirements for part (b), assuming Cheyenne and Walleye agree on a revised set of services (fewer bookkeeping services but more tax services) in the extended contract period and the modification results in a separate performance obligation. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts