Question: Exercise 18-33 During 2017, Ivanhoe Company started a construction job with a contract price of $1,590,000. The job was completed in 2019. The following Information

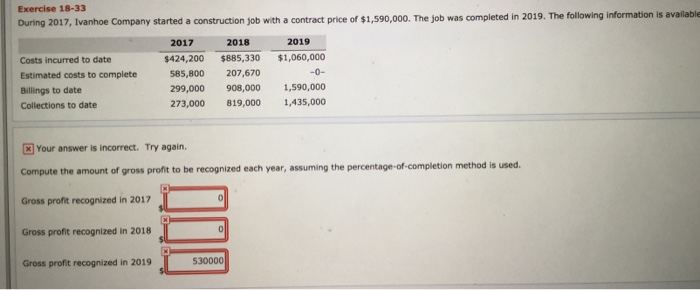

Exercise 18-33 During 2017, Ivanhoe Company started a construction job with a contract price of $1,590,000. The job was completed in 2019. The following Information is available 2017 2018 2019 Costs incurred to date Estimated costs to complete Billings to date Collections to date $424,200 $885,330 1,060,000 585,800 207,670 299,000 908,000 1,590,000 273,000 819,000 1,435,000 Your answer is incorrect. Try again. Compute the amount of gross profit to be recognized each year, assuming the percentage-of-completion method Gross profit recognized in 2017 Gross profit recognized in 2018 is used. 530000 Gross profit recognized in 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts