Question: Exercise 1-9 Fixed, Variable, and Mixed Costs LO1-4 Refer to the data given in Exercise 1-7. Answer all questions independently (1-8). Chapter 1 2/04/20 (A

Exercise 1-9 Fixed, Variable, and Mixed Costs LO1-4

Refer to the data given in Exercise 1-7. Answer all questions independently (1-8).

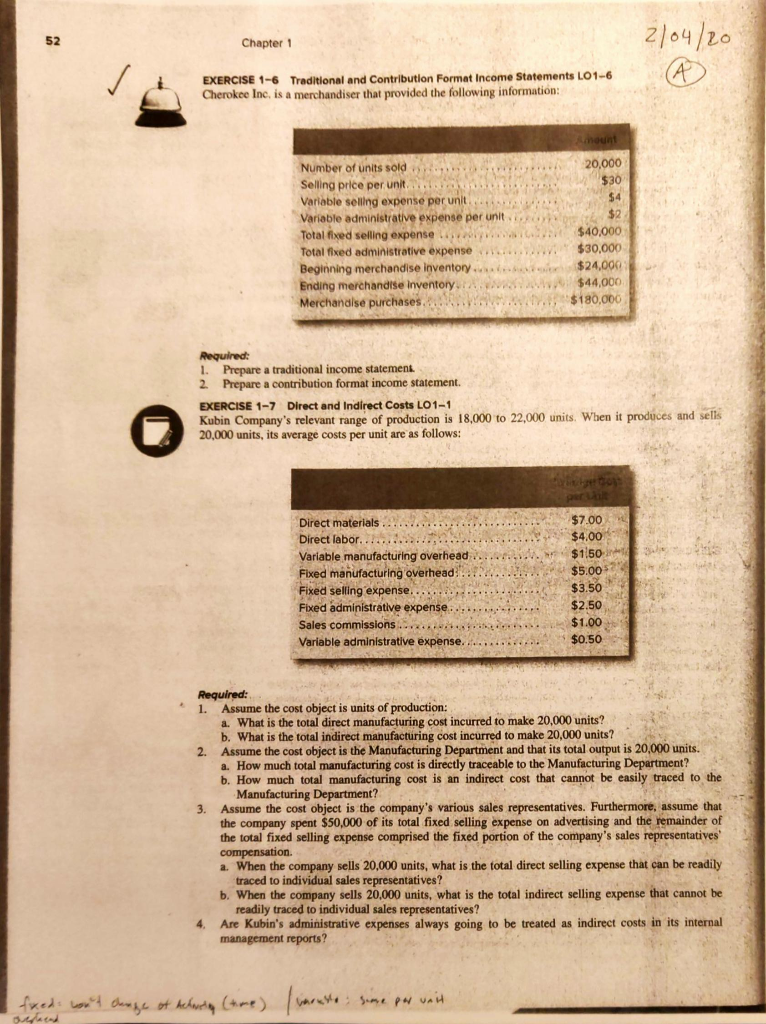

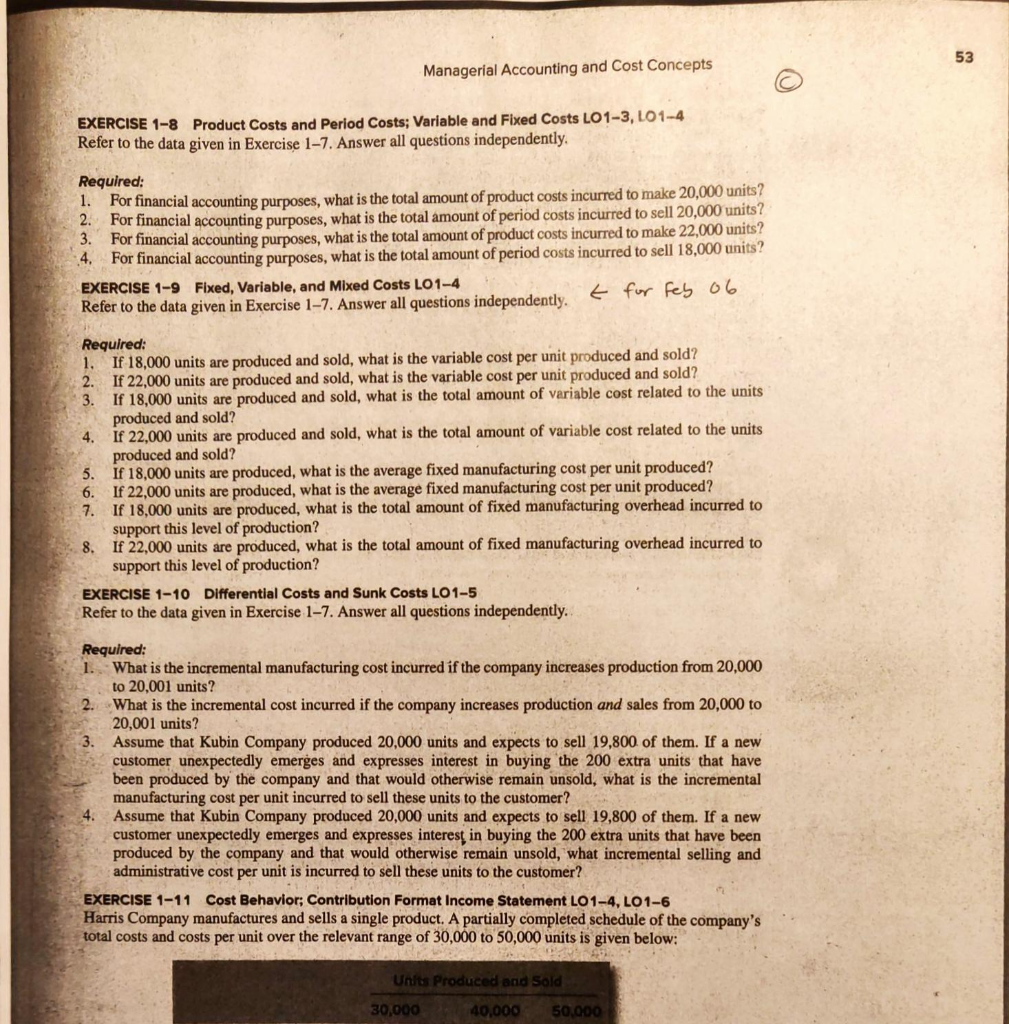

Chapter 1 2/04/20 (A EXERCISE 1-6 Traditional and Contribution Format Income Statements LO1-6 Cherokee Inc. is a merchandiser that provided the following information: mount 20,000 $30 $4 $2 Number of units sold Selling price per unit Variable selling expense per unit Variable administrative expense per unit Total fixed selling expense Lav Total fixed administrative expense Beginning merchandise inventory... Ending merchandise inventory Merchandise purchases t $40,000 $30,000 $24,000 $44,000 $180,000 Required: 1. Prepare a traditional income statement 2 Prepare a contribution format income statement. EXERCISE 1-7 Direct and Indirect Costs L01-1 Kubin Company's relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows: Direct materials .......................... Direct labor........... ...... .... Variable manufacturing overhead....... Fixed manufacturing overhead. Fixed selling expense. Fixed administrative expense..... ..... Sales commissions ... .. . Variable administrative expense..... $7.00 $4.00 $1.50 $5.00 $3.50 $2.50 $1.00 $0.50 Required: 1. Assume the cost object is units of production: a. What is the total direct manufacturing cost incurred to make 20,000 units? b. What is the total indirect manufacturing cost incurred to make 20,000 units? 2. Assume the cost object is the Manufacturing Department and that its total output is 20,000 units. a. How much total manufacturing cost is directly traceable to the Manufacturing Department? b. How much total manufacturing cost is an indirect cost that cannot be easily traced to the Manufacturing Department? 3. Assume the cost object is the company's various sales representatives. Furthermore, assume that the company spent $50,000 of its total fixed selling expense on advertising and the remainder of the total fixed selling expense comprised the fixed portion of the company's sales representatives compensation a. When the company sells 20,000 units, what is the total direct selling expense that can be readily traced to individual sales representatives? b. When the company sells 20,000 units, what is the total indirect selling expense that cannot be readily traced to individual sales representatives? 4. Are Kubin's administrative expenses always going to be treated as indirect costs in its internal management reports? fixed: won't change of actresting (time) aruste: sime par wait Managerial Accounting and Cost Concepts EXERCISE 1-8 Product Costs and Period Costs: Variable and Fixed Costs LO1-3, 101-4 Refer to the data given in Exercise 1-7. Answer all questions independently, Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 20,000 units? 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 20,000 units? 3. For financial accounting purposes, what is the total amount of product costs incurred to make 22,000 units? 4. For financial accounting purposes, what is the total amount of period costs incurred to sell 18,000 units? EXERCISE 1-9 Fixed, Variable, and Mixed Costs LO1-4 Refer to the data given in Exercise 1-7. Answer all questions independently. endently t for Feb 06 Required: 1. If 18,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 22,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 18,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? If 22.000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 18,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 22,000 units are produced, what is the average fixed manufacturing cost per unit produced? 7. If 18,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? 8. If 22,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? EXERCISE 1-10 Differential Costs and Sunk Costs LO1-5 Refer to the data given in Exercise 1-7. Answer all questions independently. Required: 1. What is the incremental manufacturing cost incurred if the company increases production from 20,000 to 20,001 units? 2. What is the incremental cost incurred if the company increases production and sales from 20,000 to 20,001 units? 3. Assume that Kubin Company produced 20,000 units and expects to sell 19,800 of them. If a new customer unexpectedly emerges and expresses interest in buying the 200 extra units that have been produced by the company and that would otherwise remain unsold, what is the incremental manufacturing cost per unit incurred to sell these units to the customer? Assume that Kubin Company produced 20,000 units and expects to sell 19,800 of them. If a new customer unexpectedly emerges and expresses interest in buying the 200 extra units that have been produced by the company and that would otherwise remain unsold, what incremental selling and administrative cost per unit is incurred to sell these units to the customer? EXERCISE 1-11 Cost Behavior; Contribution Format Income Statement LO1-4, LO1-6 Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 30,000 to 50,000 units is given below: Units Produced and sold 30,000 40,000 50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts