Question: Exercise 19-01 Wildhorse Corporation has one temporary difference at the end of 2020 that will reverse and cause taxable amounts of $52,500 in 2021, $57,500

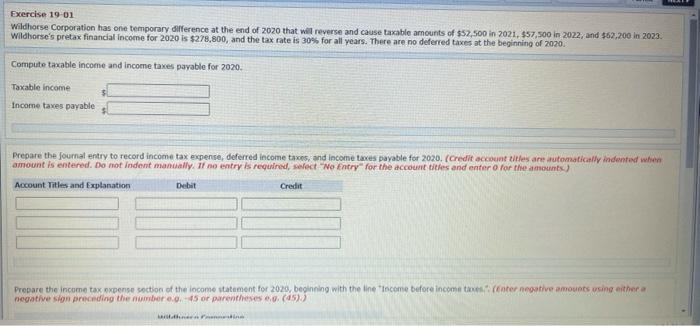

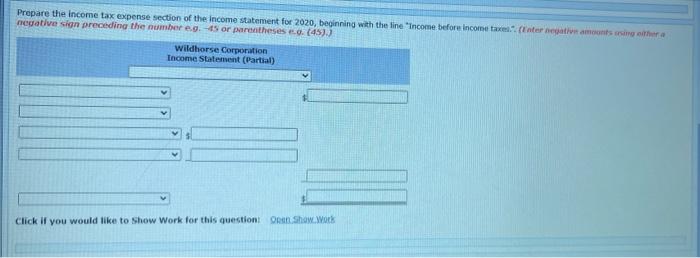

Exercise 19-01 Wildhorse Corporation has one temporary difference at the end of 2020 that will reverse and cause taxable amounts of $52,500 in 2021, $57,500 in 2022, and $62,200 in 2023. Wildhorse's pretax financial income for 2020 is $278,800, and the tax rate is 30% for all years. There are no deferred taxes at the beginning of 2020. Compute taxable income and income taxes payable for 2020. Taxable income Income taxes payable Prepare the Journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020. (Credit accountitles are automatically indented when amount is entered. Do not indent manually. It ne entry is required, select "Ne Entry for the account titles and enter for the amounts) Account Titles and Explanation Debit Credit Prepare the income tax expense section of the locome statement for 2020, beginning with the line income before income tax rater negative amounts using esther negative sin preceding the number 0.5 or parentheses (45) Prepare the income tax expense section of the income statement for 2020, beginning with the line "Income before income taxel (Enter negative among other negative sign preceding the number eg. 45 or parentheses .. (45). Wildhorse Corporation Income Statement (Partial) Click if you would like to show Work for this questioni On Show. Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts