Question: Exercise 19-1 Ayayai Corporation has one temporary difference at the end of 2017 that will reverse and cause taxable amounts of $59,400 in 2018, $64,200

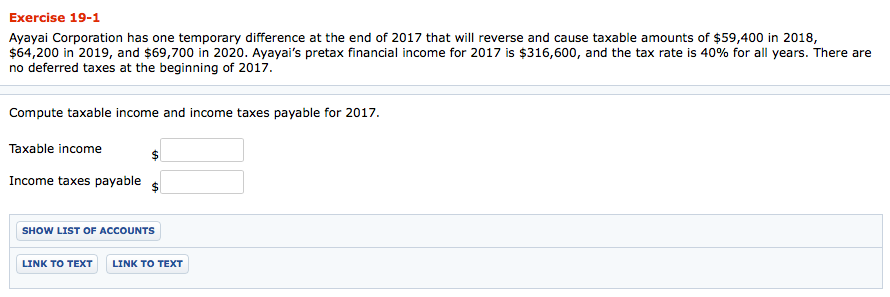

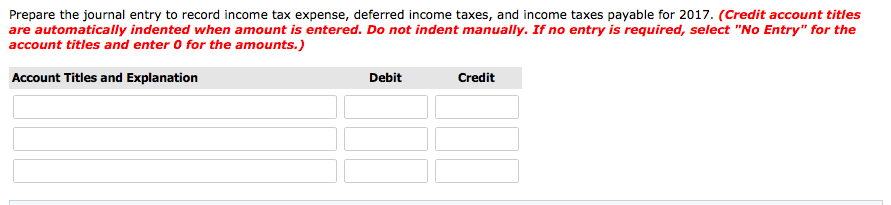

Exercise 19-1 Ayayai Corporation has one temporary difference at the end of 2017 that will reverse and cause taxable amounts of $59,400 in 2018, $64,200 in 2019, and $69,700 in 2020, Ayayai's pretax financial income for 2017 is $316,600, and the tax rate is 40% for all years. There are no deferred taxes at the beginning of 2017. Compute taxable income and income taxes payable for 2017. Taxable income Income taxes payable s SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock