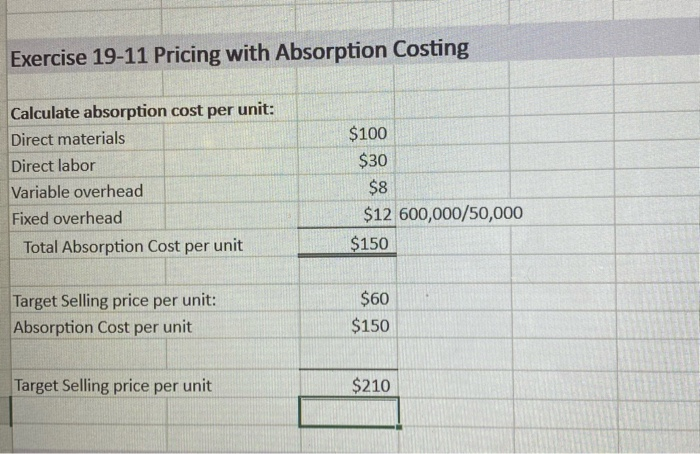

Question: Exercise 19-11 Pricing with Absorption Costing $100 $30 Calculate absorption cost per unit: Direct materials Direct labor Variable overhead Fixed overhead Total Absorption Cost per

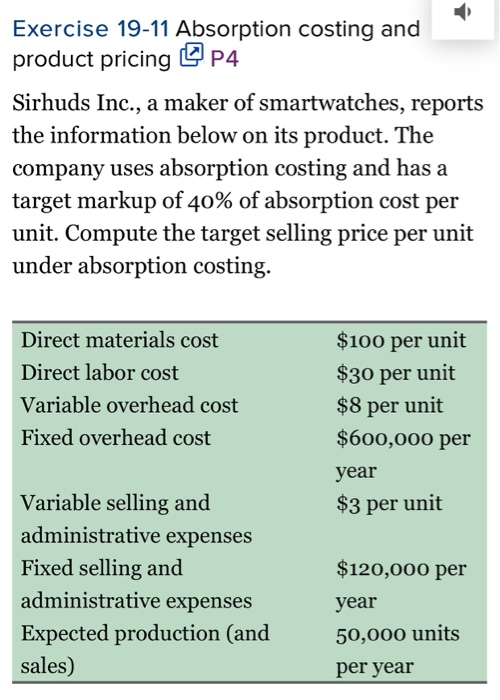

Exercise 19-11 Pricing with Absorption Costing $100 $30 Calculate absorption cost per unit: Direct materials Direct labor Variable overhead Fixed overhead Total Absorption Cost per unit $8 $12 600,000/50,000 $150 $60 Target Selling price per unit: Absorption Cost per unit $150 Target Selling price per unit $210 Exercise 19-11 Absorption costing and product pricing @P4 Sirhuds Inc., a maker of smartwatches, reports the information below on its product. The company uses absorption costing and has a target markup of 40% of absorption cost per unit. Compute the target selling price per unit under absorption costing. Direct materials cost Direct labor cost Variable overhead cost Fixed overhead cost $100 per unit $30 per unit $8 per unit $600,000 per year $3 per unit Variable selling and administrative expenses Fixed selling and administrative expenses Expected production (and sales) $120,000 per year 50,000 units per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts