Question: Exercise 19-13 Analyzing variable cost for a special order LO A1 Grand Garden is a luxury hotel with 155 suites. Its regular suite rate is

![and materials cost Fixed cost [($5,770,000/155 suites) + 365 days ] Total](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e9ac4fadb90_03166e9ac4f485b9.jpg)

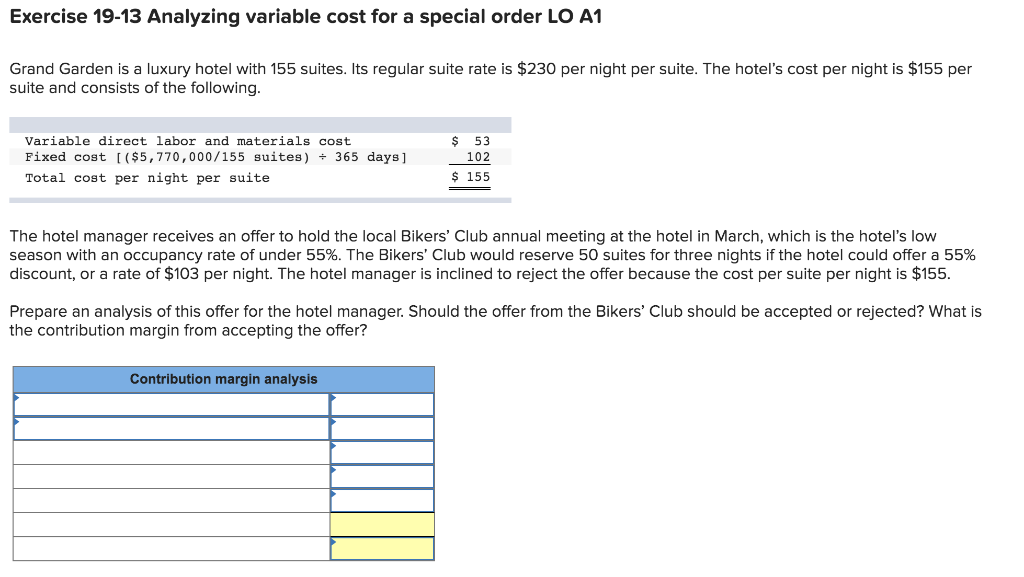

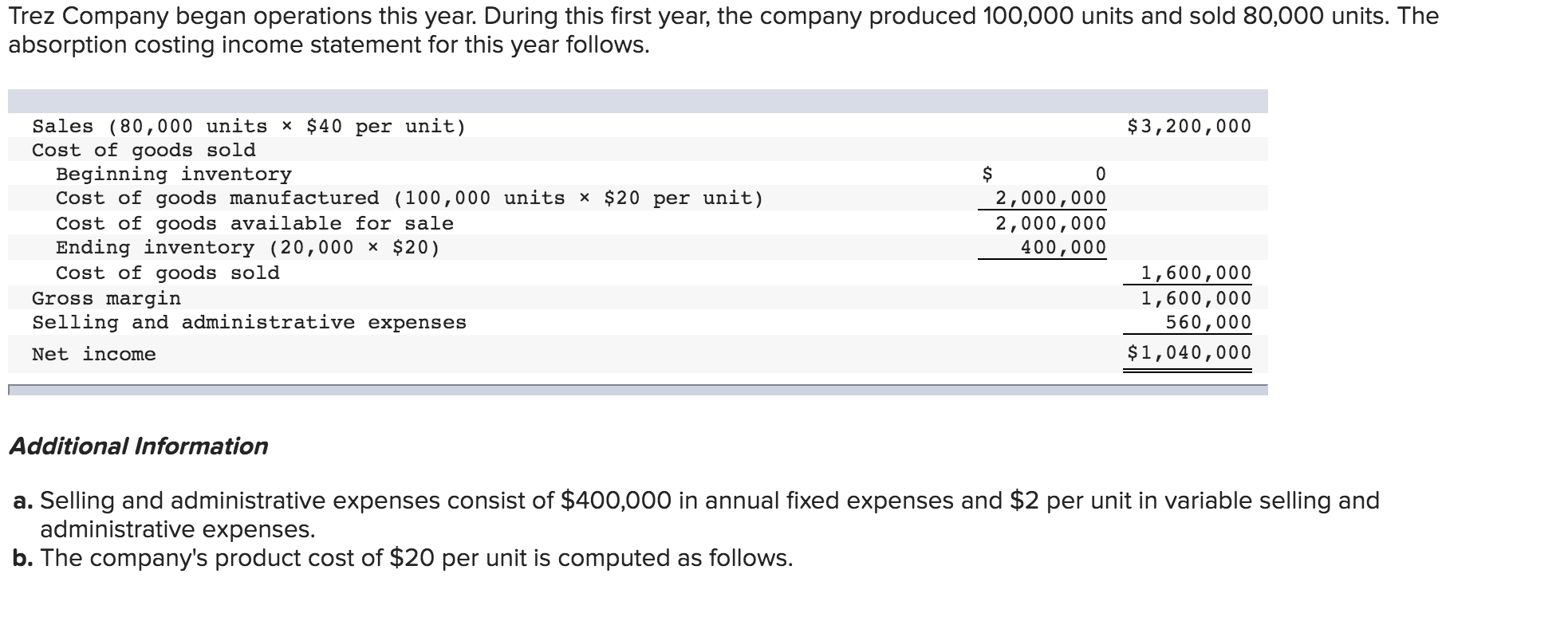

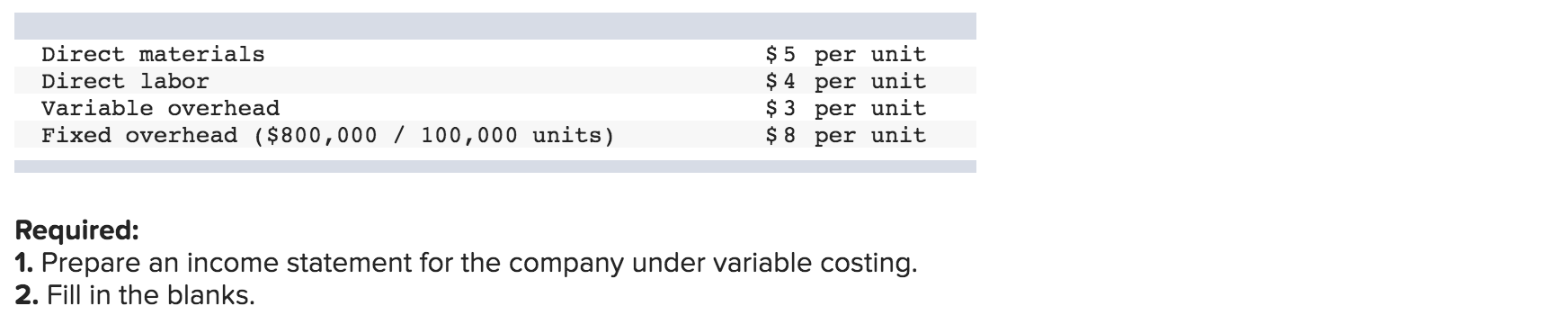

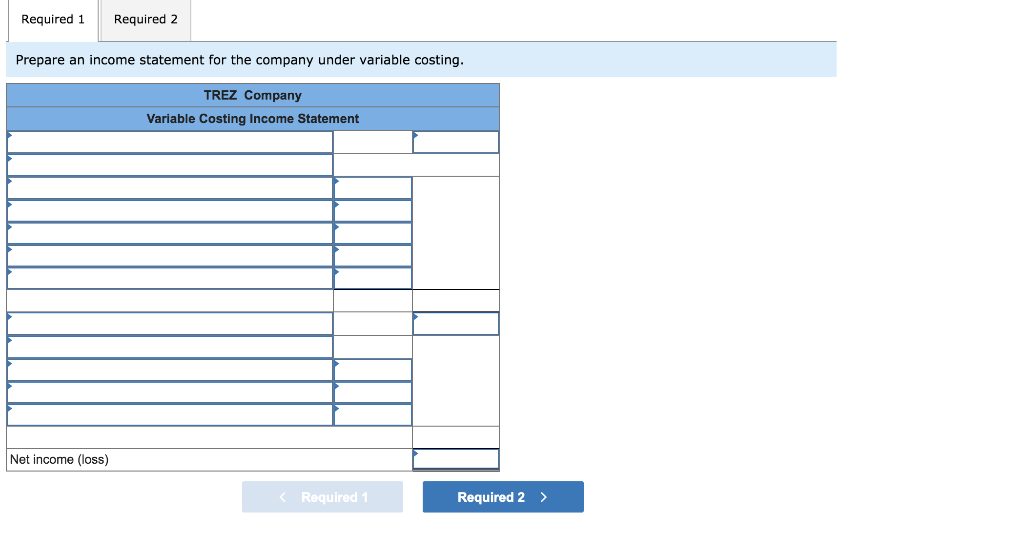

Exercise 19-13 Analyzing variable cost for a special order LO A1 Grand Garden is a luxury hotel with 155 suites. Its regular suite rate is $230 per night per suite. The hotel's cost per night is $155 per suite and consists of the following. Variable direct labor and materials cost Fixed cost [($5,770,000/155 suites) + 365 days ] Total cost per night per suite $ 53 102 $ 155 The hotel manager receives an offer to hold the local Bikers' Club annual meeting at the hotel in March, which is the hotel's low season with an occupancy rate of under 55%. The Bikers' Club would reserve 50 suites for three nights if the hotel could offer a 55% discount, or a rate of $103 per night. The hotel manager is inclined to reject the offer because the cost per suite per night is $155. Prepare an analysis of this offer for the hotel manager. Should the offer from the Bikers' Club should be accepted or rejected? What is the contribution margin from accepting the offer? Contribution margin analysis Trez Company began operations this year. During this first year, the company produced 100,000 units and sold 80,000 units. The absorption costing income statement for this year follows. $3,200,000 Sales (80,000 units * $ 40 per unit) Cost of goods sold Beginning inventory Cost of goods manufactured (100,000 units * $20 per unit) Cost of goods available for sale Ending inventory (20,000 * $20) Cost of goods sold Gross margin Selling and administrative expenses Net income $ 0 2,000,000 2,000,000 400,000 1,600,000 1,600,000 560,000 $1,040,000 Additional Information a. Selling and administrative expenses consist of $400,000 in annual fixed expenses and $2 per unit in variable selling and administrative expenses. b. The company's product cost of $20 per unit is computed as follows. Direct materials Direct labor Variable overhead Fixed overhead ($800,000 / 100,000 units) $5 per unit $ 4 per unit $3 per unit $ 8 per unit Required: 1. Prepare an income statement for the company under variable costing. 2. Fill in the blanks. Required 1 Required 2 Prepare an income statement for the company under variable costing. TREZ Company Variable Costing Income Statement Net income (loss) Required 1 Required 2 Fill in the blanks. The dollar difference in variable costing income and absorption costing income = units X fixed overhead per unit.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts