Question: Exercise 19-20 (Part Level Submission) The differences between the book basis and tax basis of the assets and liabilities of Crane Corporation at the end

Exercise 19-20 (Part Level Submission)

The differences between the book basis and tax basis of the assets and liabilities of Crane Corporation at the end of 2016 are presented below.

| Book Basis | Tax Basis | |||

| Accounts receivable | $52,200 | $0 | ||

| Litigation liability | 31,200 | 0 |

It is estimated that the litigation liability will be settled in 2017. The difference in accounts receivable will result in taxable amounts of $31,600 in 2017 and $20,600 in 2018. The company has taxable income of $378,000 in 2016 and is expected to have taxable income in each of the following 2 years. Its enacted tax rate is 34% for all years. This is the companys first year of operations. The operating cycle of the business is 2 years.

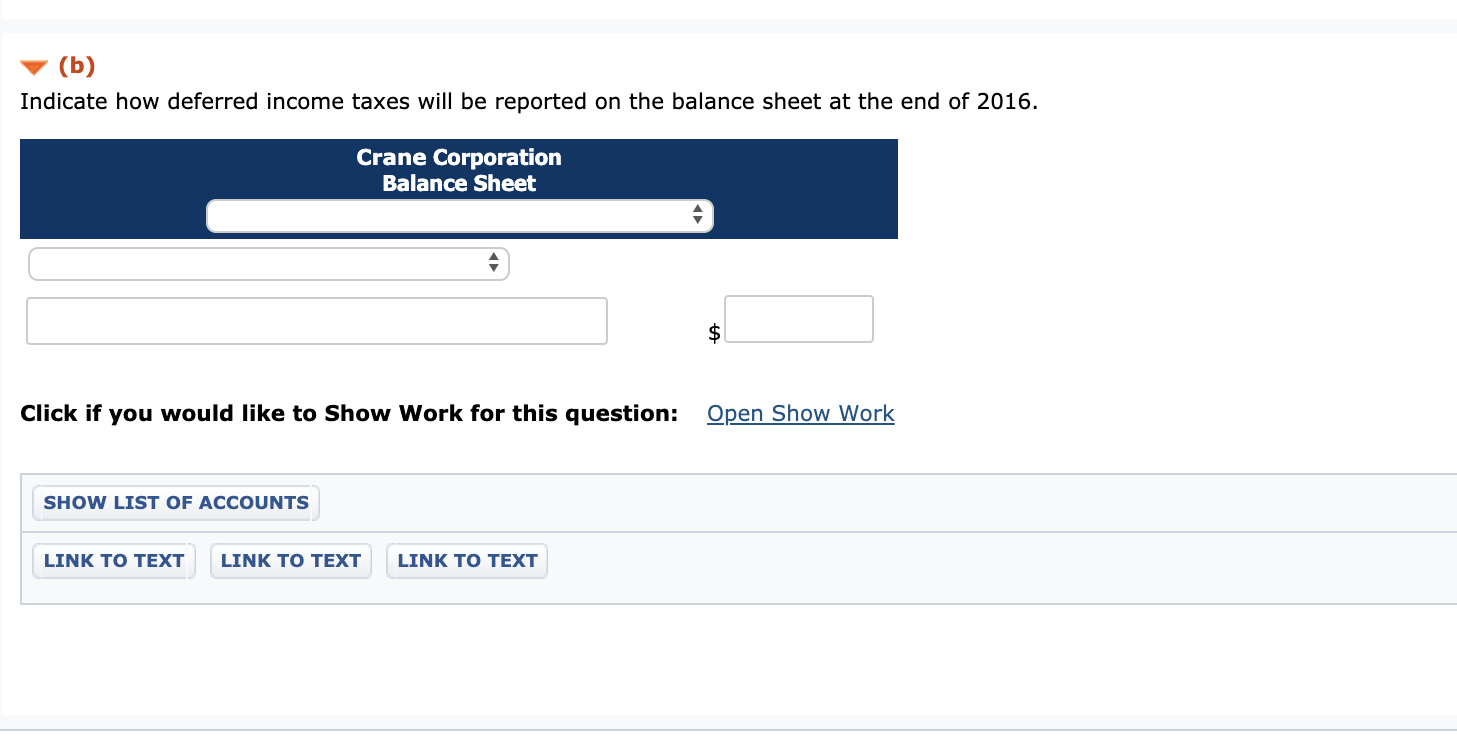

(b) Indicate how deferred income taxes will be reported on the balance sheet at the end of 2016. Crane Corporation Balance Sheet $ Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts