Question: Exercise 19-6 Absorption costing income statement LO P2 1.18 points Hayek Bikes prepares the income statement under variable costing for its managerial reports, and it

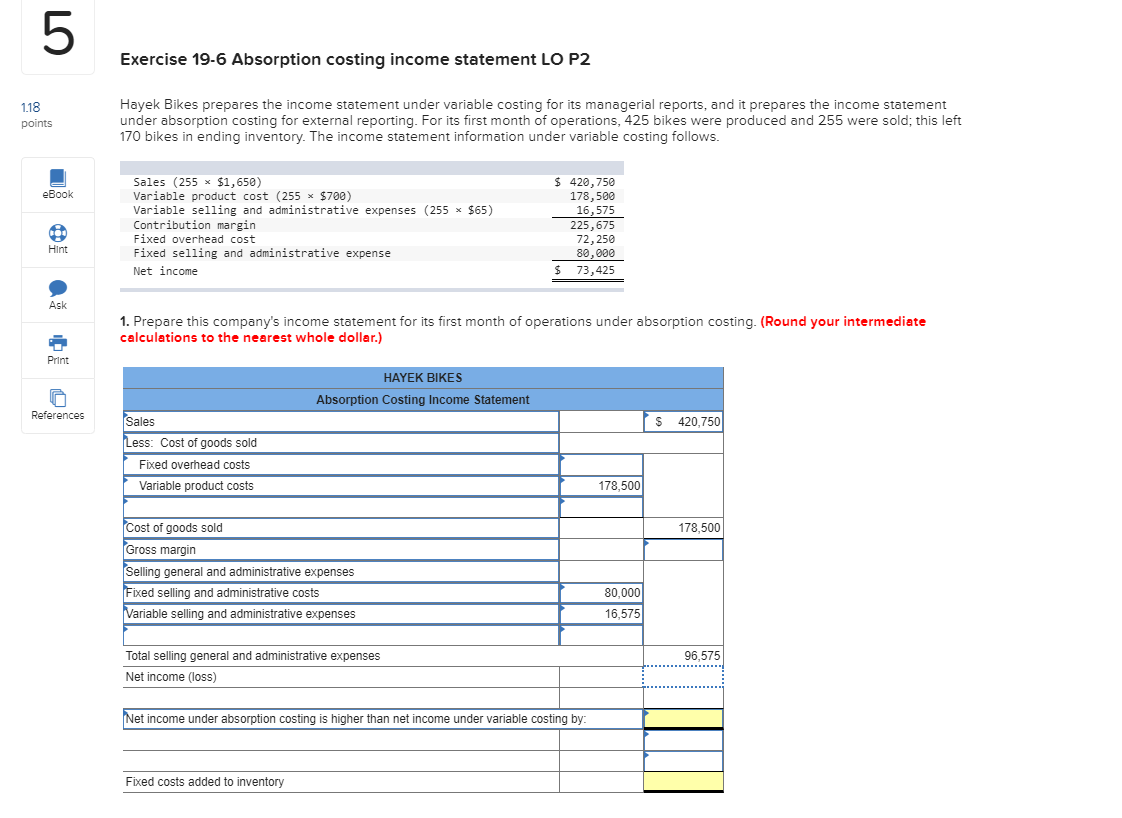

Exercise 19-6 Absorption costing income statement LO P2 1.18 points Hayek Bikes prepares the income statement under variable costing for its managerial reports, and it prepares the income statement under absorption costing for external reporting. For its first month of operations, 425 bikes were produced and 255 were sold, this left 170 bikes in ending inventory. The income statement information under variable costing follows. eBook Sales (255 * $1,650) Variable product cost (255 x $700) Variable selling and administrative expenses (255 * $65) Contribution margin Fixed overhead cost Fixed selling and administrative expense Net income $ 420,750 178,500 16,575 225,675 72,250 80,000 $ 73,425 Hint Ask 1. Prepare this company's income statement for its first month of operations under absorption costing. (Round your intermediate calculations to the nearest whole dollar.) Print HAYEK BIKES Absorption Costing Income Statement References $ 420,750 Sales Less: Cost of goods sold Fixed overhead costs Variable product costs [ 178,500 178,500 Cost of goods sold Gross margin Selling general and administrative expenses Fixed selling and administrative costs Variable selling and administrative expenses 80,000 16,575 96.575 Total selling general and administrative expenses Net income (loss) Net income under absorption costing is higher than net income under variable costing by: Fixed costs added to inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts