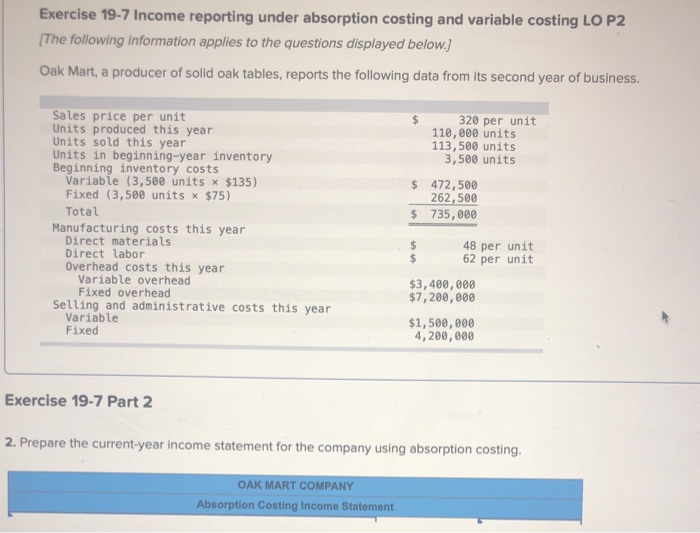

Question: Exercise 19-7 Income reporting under absorption costing and variable costing LO P2 [The following information applies to the questions displayed below.) Oak Mart, a producer

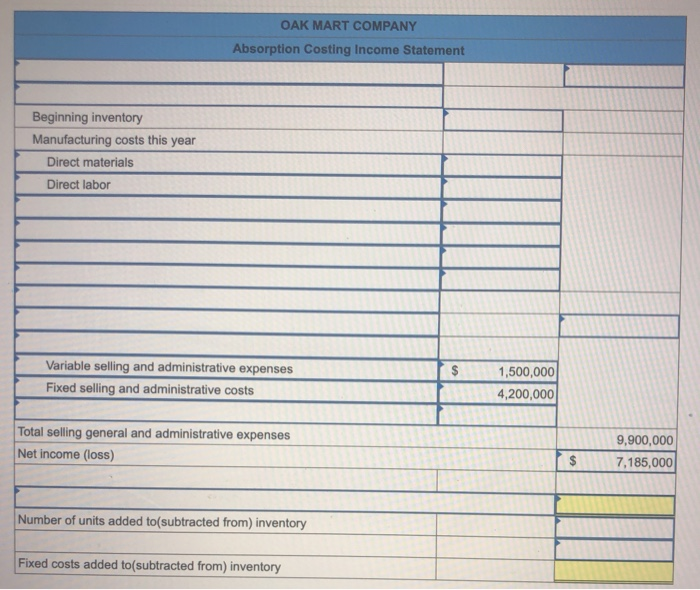

Exercise 19-7 Income reporting under absorption costing and variable costing LO P2 [The following information applies to the questions displayed below.) Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. 320 per unit 110,000 units 113,500 units 3,500 units $ 472,500 262,500 $ 735,000 Sales price per unit Units produced this year Units sold this year Units in beginning-year inventory Beginning inventory costs Variable (3,500 units * $135) Fixed (3,500 units * $75) Total Manufacturing costs this year Direct materials Direct labor Overhead costs this year Variable overhead Fixed overhead Selling and administrative costs this year Variable Fixed 48 per unit 62 per unit $3,400,000 $7,200,000 $1,500,000 4,200,000 Exercise 19-7 Part 2 2. Prepare the current-year income statement for the company using absorption costing. OAK MART COMPANY Absorption Costing Income Statement OAK MART COMPANY Absorption Costing Income Statement Beginning inventory Manufacturing costs this year Direct materials Direct labor Variable selling and administrative expenses Fixed selling and administrative costs 1,500,000 4,200,000 Total selling general and administrative expenses Net income (loss) 9,900,000 7,185,000 Number of units added to(subtracted from) inventory Fixed costs added to(subtracted from) inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts