Question: Exercise 19-8 (Algo) Variable costing income statement LO P2 Kenzi, a manufacturer of kayaks, began operations this year. During this year, the company produced

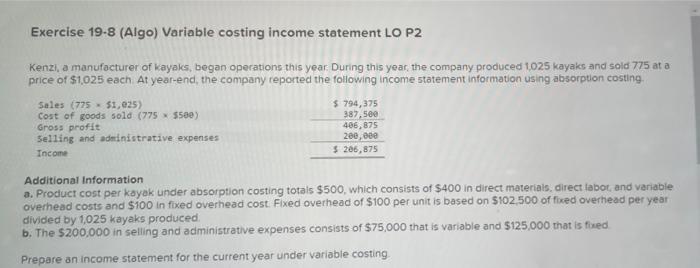

Exercise 19-8 (Algo) Variable costing income statement LO P2 Kenzi, a manufacturer of kayaks, began operations this year. During this year, the company produced 1,025 kayaks and sold 775 at a price of $1,025 each At year-end, the company reported the following income statement information using absorption costing. Sales (775 $1,025) Cost of goods sold (775 x $500) Gross profit Selling and administrative expenses Income $ 794,375 387,500 406,875 200,000 $ 206,875 Additional Information a. Product cost per kayak under absorption costing totals $500, which consists of $400 in direct materials, direct labor, and variable overhead costs and $100 in fixed overhead cost. Fixed overhead of $100 per unit is based on $102,500 of fixed overhead per year divided by 1,025 kayaks produced. b. The $200,000 in selling and administrative expenses consists of $75,000 that is variable and $125,000 that is fixed Prepare an income statement for the current year under variable costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts