Question: Exercise 2 0 - 1 2 ( Algorithmic ) ( L 0 . 1 ) The entity reports the following transactions for the 2 0

Exercise AlgorithmicL

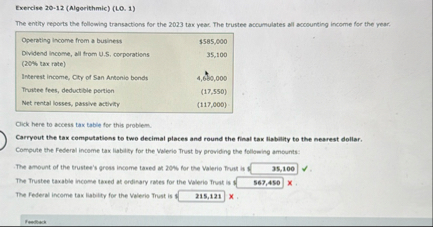

The entity reports the following transactions for the tax yeac. The trustee acoumulates all accounting income for the year.

tableOperating income from a business,$Dividend income, all from US corporations tax rateInterest income, Cty of San Artonio bonds,Truitee fees, deductible pertion,Net rental losses, pasiove activity,

Oick here to acoess tax table for this problem.

Carryout the tax computations to two decimal places and round the final tax liability to the nearest dollar.

Compute the Federal income tax liabity for the Voleris Thust by providing the following amounts:

The amount of the trustee's gress income tased at s for the Valerie frust is is

The Trustee taxable income tased at erdinary rates for the Waleris Thas is i

The Federal income tax liabilty for the Velerie Trust is X

mom

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock