Question: Exercise 2 - 2 2 Interpreting the debt ratio and return on assets LO A 2 Complete this question by entering your answers in the

Exercise Interpreting the debt ratio and return on assets LO A Complete this question by entering your answers in the tabs be

Required

Required C

Calculate the debt ratio and the return on assets. Round your debt rat decimal places. Enter all answers in numbers and not in percentages.

tableCaseDebt Ratio,ROAtableCompanyxtableCompanyxtableCompanyxtableCompanyxtableCompanyxtableCompanyx

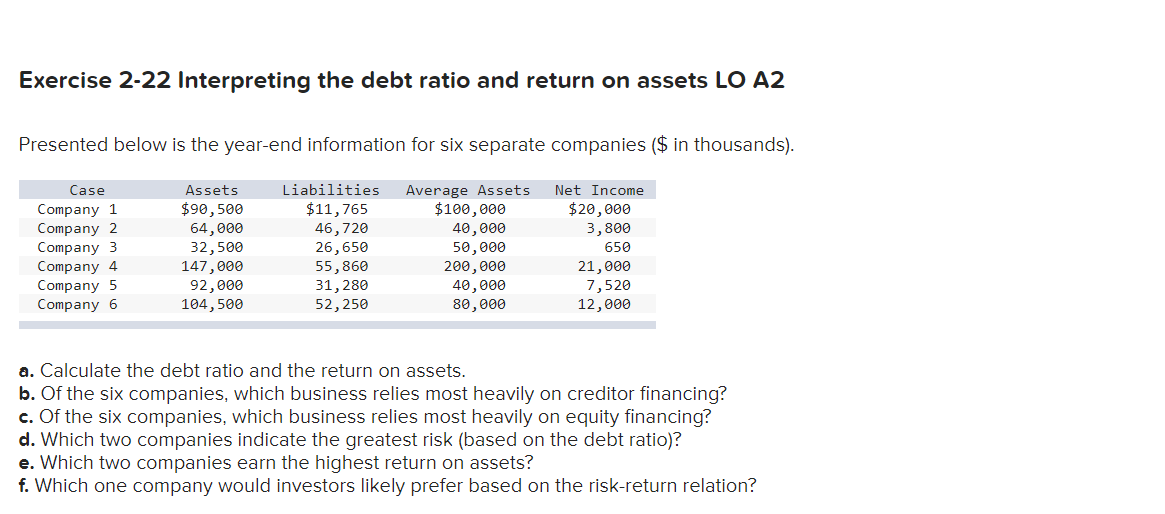

Presented below is the yearend information for six separate companies $ in thousands

tableCaseAssets,Liabilities,Average Assets,Net IncomeCompany $$$$Company Company Company Company Company

a Calculate the debt ratio and the return on assets.

b Of the six companies, which business relies most heavily on creditor financing?

c Of the six companies, which business relies most heavily on equity financing?

d Which two companies indicate the greatest risk based on the debt ratio

e Which two companies earn the highest return on assets?

f Which one company would investors likely prefer based on the riskreturn relation?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock