Question: Exercise 2 2 On January 2 , 2 0 1 2 , Lynch Company acquired machinery at a cost of $ 8 0 0 ,

Exercise

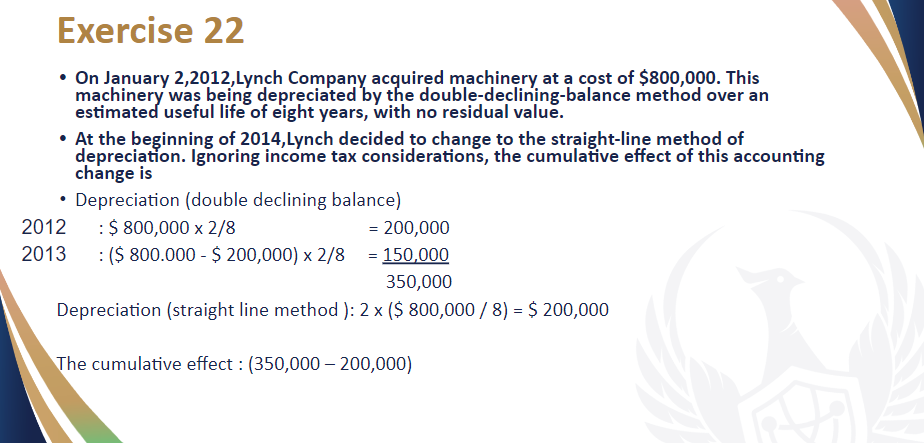

On January Lynch Company acquired machinery at a cost of $ This

machinery was being depreciated by the doubledecliningbalance method over an

estimated useful life of eight years, with no residual value.

At the beginning of Lynch decided to change to the straightline method of

depreciation. Ignoring income tax considerations, the cumulative effect of this accounting

change is

Depreciation double declining balance

:$

:$$

Depreciation straight line method : x $$

The cumulative effect :

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock