Question: Exercise 2 (75 points) Below you find the comparative statements of financial position for the company Snow Ltd. Note that the table shows values for

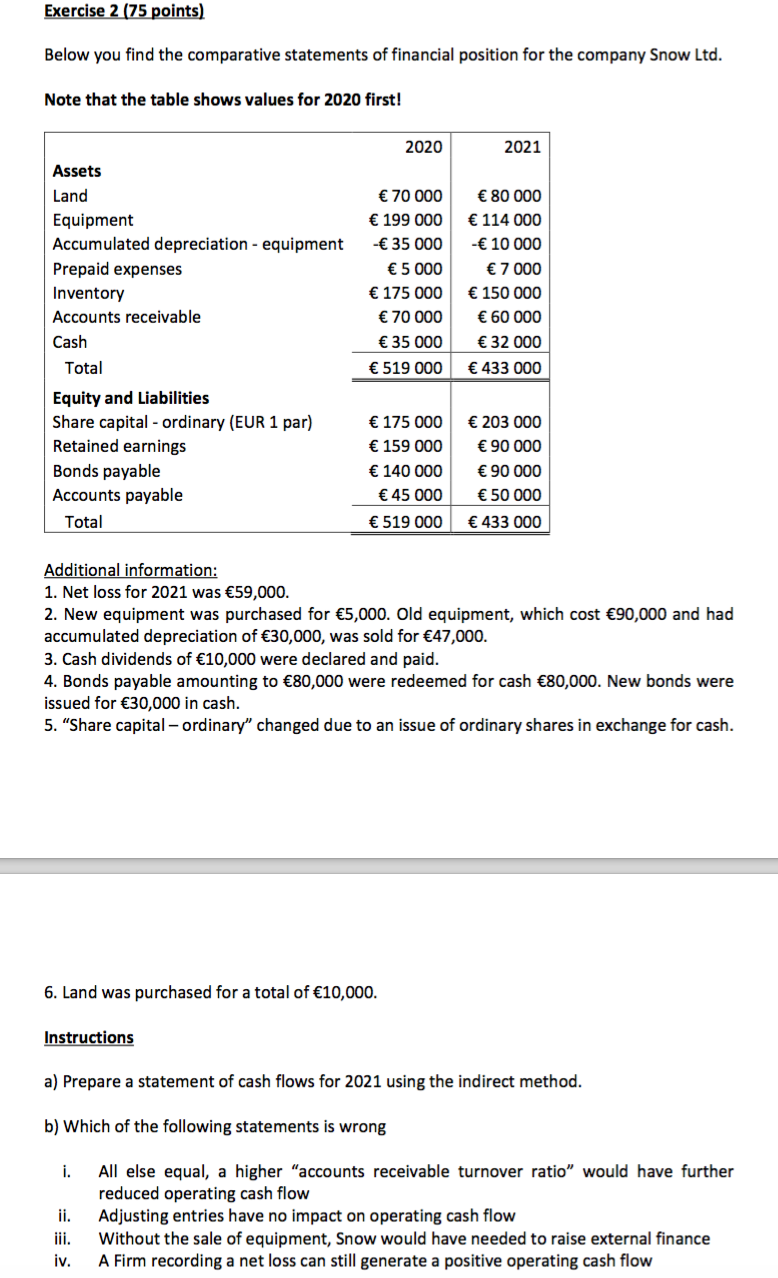

Exercise 2 (75 points) Below you find the comparative statements of financial position for the company Snow Ltd. Note that the table shows values for 2020 first! 2020 2021 Assets Land 70 000 80 000 Equipment 199 000 114 000 Accumulated depreciation - equipment - 35 000 - 10 000 Prepaid expenses 5 000 7 000 Inventory 175 000 150 000 Accounts receivable 70 000 60 000 Cash 35 000 32 000 Total 519 000 433 000 Equity and Liabilities Share capital - ordinary (EUR 1 par) 175 000 203 000 Retained earnings 159 000 90 000 Bonds payable 140 000 90 000 Accounts payable 45 000 50 000 Total 519 000 433 000 Additional information: 1. Net loss for 2021 was 59,000. 2. New equipment was purchased for 5,000. Old equipment, which cost 90,000 and had accumulated depreciation of 30,000, was sold for 47,000. 3. Cash dividends of 10,000 were declared and paid. 4. Bonds payable amounting to 80,000 were redeemed for cash 80,000. New bonds were issued for 30,000 in cash. 5. "Share capital - ordinary" changed due to an issue of ordinary shares in exchange for cash. 6. Land was purchased for a total of 10,000. Instructions a) Prepare a statement of cash flows for 2021 using the indirect method. b) Which of the following statements is wrong i. All else equal, a higher "accounts receivable turnover ratio" would have further reduced operating cash flow ii. Adjusting entries have no impact on operating cash flow iii. Without the sale of equipment, Snow would have needed to raise external finance A Firm recording a net loss can still generate a positive operating cash flow iv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts