Question: Exercise 2: a. Calculate your portfolio beta using daily returns and using the S&P 500 to approximate the market return. This will require that you

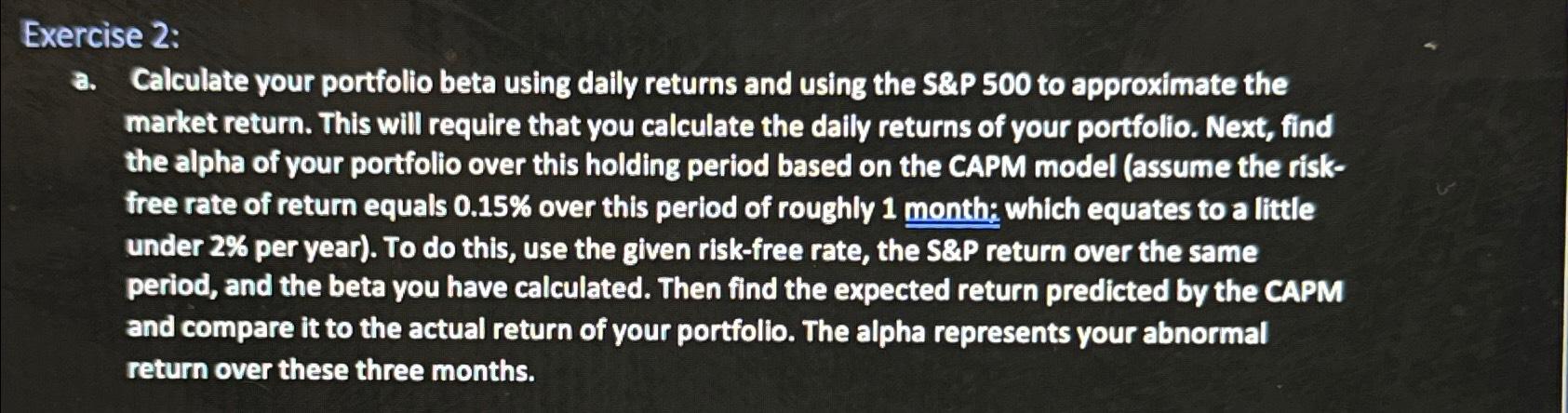

Exercise 2:\ a. Calculate your portfolio beta using daily returns and using the S&P 500 to approximate the market return. This will require that you calculate the daily returns of your portfolio. Next, find the alpha of your portfolio over this holding period based on the CAPM model (assume the riskfree rate of return equals

0.15%over this period of roughly 1 month; which equates to a little under

2%per year). To do this, use the given risk-free rate, the S&P return over the same period, and the beta you have calculated. Then find the expected return predicted by the CAPM and compare it to the actual return of your portfolio. The alpha represents your abnormal return over these three months.

xercise 2: a. Calculate your portfolio beta using daily returns and using the S\&P 500 to approximate the market return. This will require that you calculate the daily returns of your portfolio. Next, find the alpha of your portfolio over this holding period based on the CAPM model (assume the riskfree rate of return equals 0.15% over this period of roughly 1 month; which equates to a little under 2% per year). To do this, use the given risk-free rate, the S\&P return over the same period, and the beta you have calculated. Then find the expected return predicted by the CAPM and compare it to the actual return of your portfolio. The alpha represents your abnormal return over these three months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts