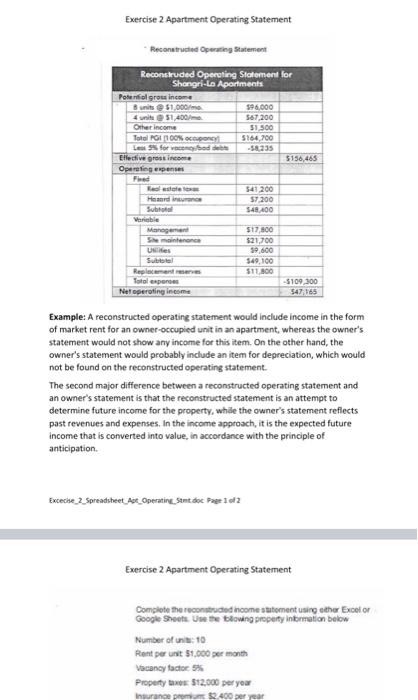

Question: Exercise 2 Apartment Operating Statement Reconstructed Operating Statement Reconstruded Operating Statement for Shangri-La Apartments $96,000 $67,200 $1,500 $164,700 -58,235 Effective gross income Operating expenses Fixed

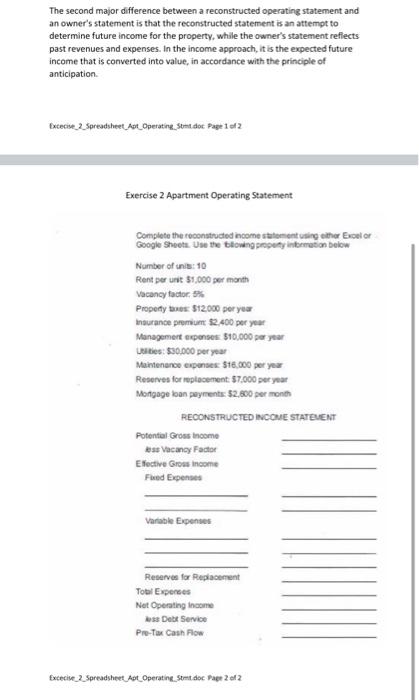

Exercise 2 Apartment Operating Statement Reconstructed Operating Statement Reconstruded Operating Statement for Shangri-La Apartments $96,000 $67,200 $1,500 $164,700 -58,235 Effective gross income Operating expenses Fixed Real estate 541,200 Heard insurance $7,200 Subtotal $48,400 Management $17,800 She maintenance $21,700 Usilites 39,600 Subtotal $49,100 Replacement reserves $11,800 Total expenses -$109,300 547,165 Net operating income Example: A reconstructed operating statement would include income in the form of market rent for an owner-occupied unit in an apartment, whereas the owner's statement would not show any income for this item. On the other hand, the owner's statement would probably include an item for depreciation, which would not be found on the reconstructed operating statement. The second major difference between a reconstructed operating statement and an owner's statement is that the reconstructed statement is an attempt to determine future income for the property, while the owner's statement reflects past revenues and expenses. In the income approach, it is the expected future income that is converted into value, in accordance with the principle of anticipation. Excecise_2_Spreadsheet_Apt Operating Stit.doc Page 1 of 2 Potential gross income 8 units@ $1,000/m 4 units@ $1,400/m Other income Total PGI (100% occupancy Les 5% for vacency/bod debts Variable $156,465 Exercise 2 Apartment Operating Statement Complete the reconstructed income statement using either Excel or Google Sheets. Use the flowing property information below Number of units: 10 Rent per unit $1,000 per month Vacancy factor 5% Property taxes: $12,000 per year Insurance premium $2,400 per year The second major difference between a reconstructed operating statement and an owner's statement is that the reconstructed statement is an attempt to determine future income for the property, while the owner's statement reflects past revenues and expenses. In the income approach, it is the expected future income that is converted into value, in accordance with the principle of anticipation. Excecise 2 Spreadsheet Apt Operating Stmt.doc Page 1 of 2 Exercise 2 Apartment Operating Statement Complete the reconstructed income statement using either Excel or Google Sheets. Use the blowing property information below Number of unis: 10 Rent per unit $1,000 per month Vacancy factor 5% Property taxes: $12,000 per year Insurance premium: $2,400 per year Management expenses: $10,000 per year Utilities: $30,000 per year Maintenance expenses: $16,000 per year Reserves for replacement: $7,000 per year Mortgage loan payments: $2,600 per month Potential Gross Income Jess Vacancy Factor Efective Gross income Fixed Expenses Variable Expenses Reserves for Replacement Total Expenses Net Operating Income less Debt Service Pre-Tax Cash Flow Excecise 2 Spreadsheet Apt Operating Stmt.doc Page 2 of 2 RECONSTRUCTED INCOME STATEMENT Exercise 2 Apartment Operating Statement Reconstructed Operating Statement Reconstruded Operating Statement for Shangri-La Apartments $96,000 $67,200 $1,500 $164,700 -58,235 Effective gross income Operating expenses Fixed Real estate 541,200 Heard insurance $7,200 Subtotal $48,400 Management $17,800 She maintenance $21,700 Usilites 39,600 Subtotal $49,100 Replacement reserves $11,800 Total expenses -$109,300 547,165 Net operating income Example: A reconstructed operating statement would include income in the form of market rent for an owner-occupied unit in an apartment, whereas the owner's statement would not show any income for this item. On the other hand, the owner's statement would probably include an item for depreciation, which would not be found on the reconstructed operating statement. The second major difference between a reconstructed operating statement and an owner's statement is that the reconstructed statement is an attempt to determine future income for the property, while the owner's statement reflects past revenues and expenses. In the income approach, it is the expected future income that is converted into value, in accordance with the principle of anticipation. Excecise_2_Spreadsheet_Apt Operating Stit.doc Page 1 of 2 Potential gross income 8 units@ $1,000/m 4 units@ $1,400/m Other income Total PGI (100% occupancy Les 5% for vacency/bod debts Variable $156,465 Exercise 2 Apartment Operating Statement Complete the reconstructed income statement using either Excel or Google Sheets. Use the flowing property information below Number of units: 10 Rent per unit $1,000 per month Vacancy factor 5% Property taxes: $12,000 per year Insurance premium $2,400 per year The second major difference between a reconstructed operating statement and an owner's statement is that the reconstructed statement is an attempt to determine future income for the property, while the owner's statement reflects past revenues and expenses. In the income approach, it is the expected future income that is converted into value, in accordance with the principle of anticipation. Excecise 2 Spreadsheet Apt Operating Stmt.doc Page 1 of 2 Exercise 2 Apartment Operating Statement Complete the reconstructed income statement using either Excel or Google Sheets. Use the blowing property information below Number of unis: 10 Rent per unit $1,000 per month Vacancy factor 5% Property taxes: $12,000 per year Insurance premium: $2,400 per year Management expenses: $10,000 per year Utilities: $30,000 per year Maintenance expenses: $16,000 per year Reserves for replacement: $7,000 per year Mortgage loan payments: $2,600 per month Potential Gross Income Jess Vacancy Factor Efective Gross income Fixed Expenses Variable Expenses Reserves for Replacement Total Expenses Net Operating Income less Debt Service Pre-Tax Cash Flow Excecise 2 Spreadsheet Apt Operating Stmt.doc Page 2 of 2 RECONSTRUCTED INCOME STATEMENT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts