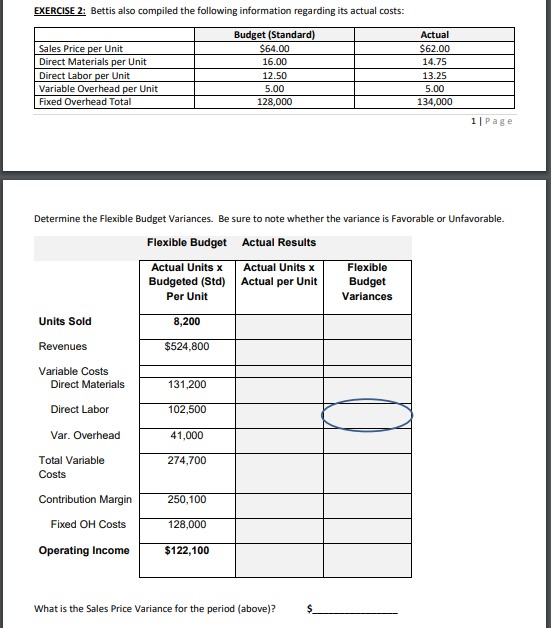

Question: EXERCISE 2: Bettis also compiled the following information regarding its actual costs: Actual Budget (Standard) $64.00 Sales Price per Unit $62.00 Direct Materials per Unit

EXERCISE 2: Bettis also compiled the following information regarding its actual costs: Actual Budget (Standard) $64.00 Sales Price per Unit $62.00 Direct Materials per Unit 16.00 14.75 Direct Labor per Unit Variable Overhead per Unit Fixed Overhead Total 12.50 13.25 5.00 5.00 128,000 134,000 1| Page Determine the Flexible Budget Variances. Be sure to note whether the variance is Favorable or Unfavorable. Flexible Budget Actual Results Actual Units x Actual Units x Flexible Budgeted (Std) Actual per Unit Budget Per Unit Variances Units Sold 8,200 Revenues $524,800 Variable Costs Direct Materials 131,200 Direct Labor 102,500 Var. Overhead 41,000 Total Variable 274,700 Costs Contribution Margin 250,100 Fixed OH Costs 128,000 Operating Income $122,100 What is the Sales Price Variance for the period (above)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts