Question: Exercise 2 Consider the simple FI balance sheet below (in millions of dollars) before the withdrawal a. Suppose that depositors unexpectedly withdraw $50 million in

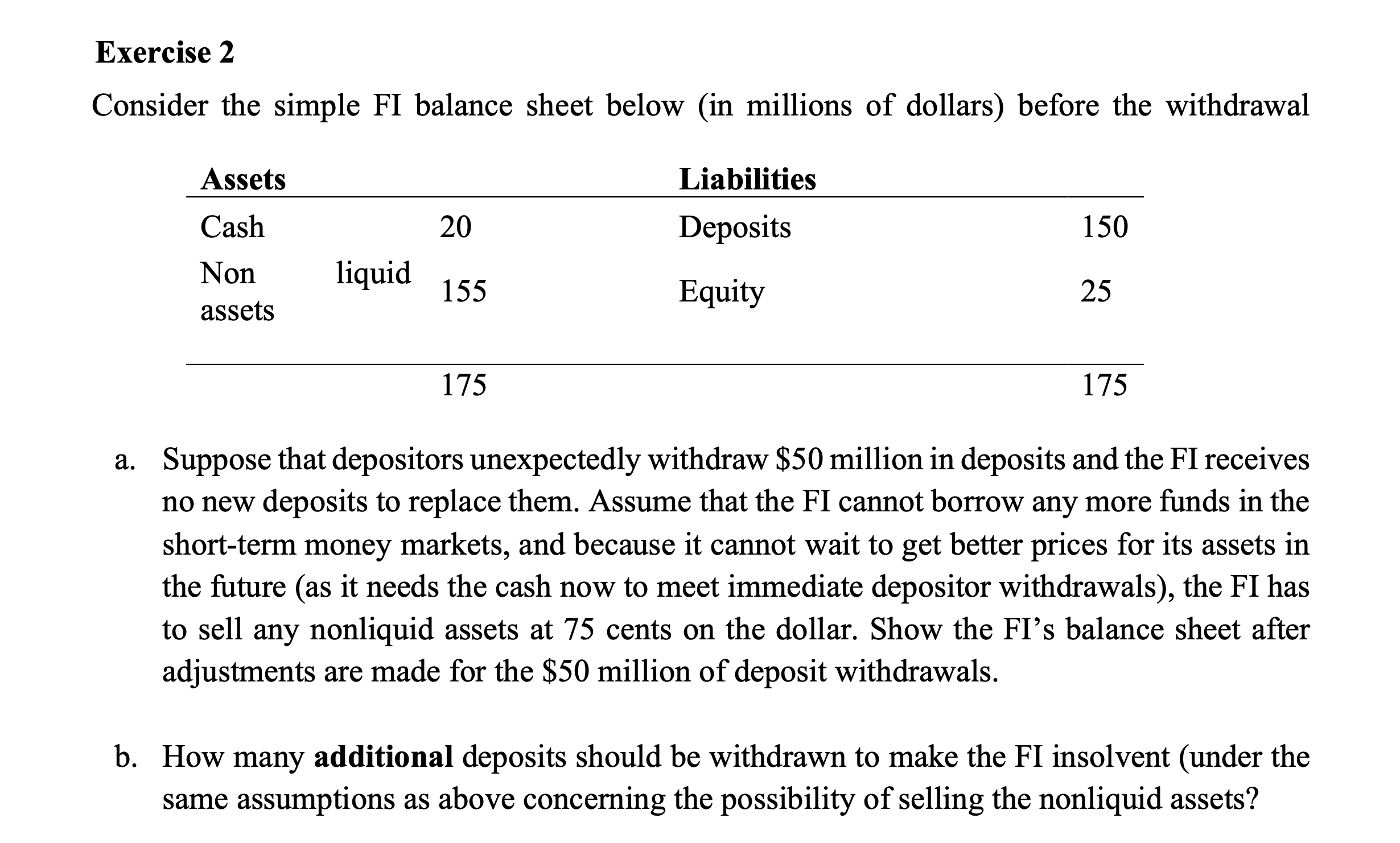

Exercise 2 Consider the simple FI balance sheet below (in millions of dollars) before the withdrawal a. Suppose that depositors unexpectedly withdraw $50 million in deposits and the FI receives no new deposits to replace them. Assume that the FI cannot borrow any more funds in the short-term money markets, and because it cannot wait to get better prices for its assets in the future (as it needs the cash now to meet immediate depositor withdrawals), the FI has to sell any nonliquid assets at 75 cents on the dollar. Show the FI's balance sheet after adjustments are made for the $50 million of deposit withdrawals. b. How many additional deposits should be withdrawn to make the FI insolvent (under the same assumptions as above concerning the possibility of selling the nonliquid assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts