Question: EXERCISE 2: Gerald Manufacturing makes two different Products, M and N. The company's two departments are named after the products. Product M is made in

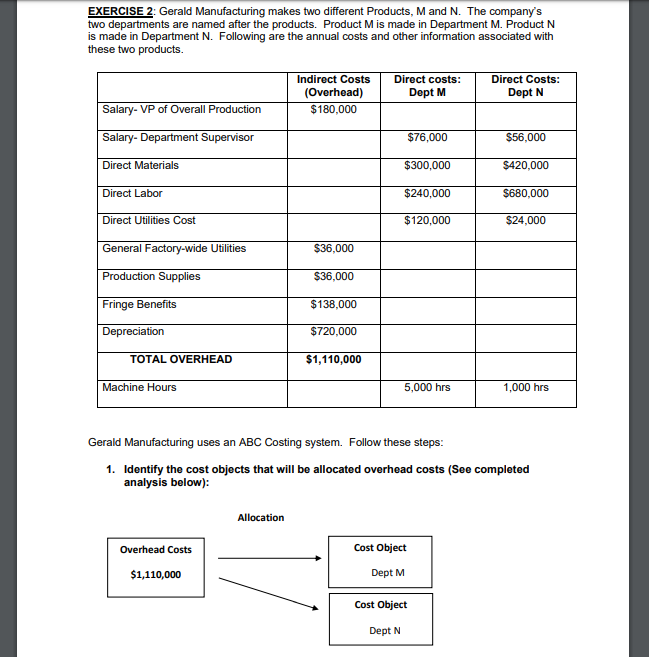

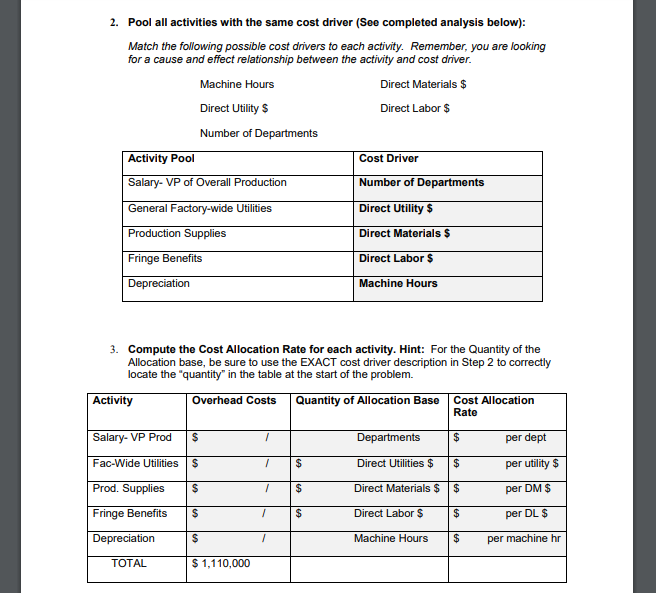

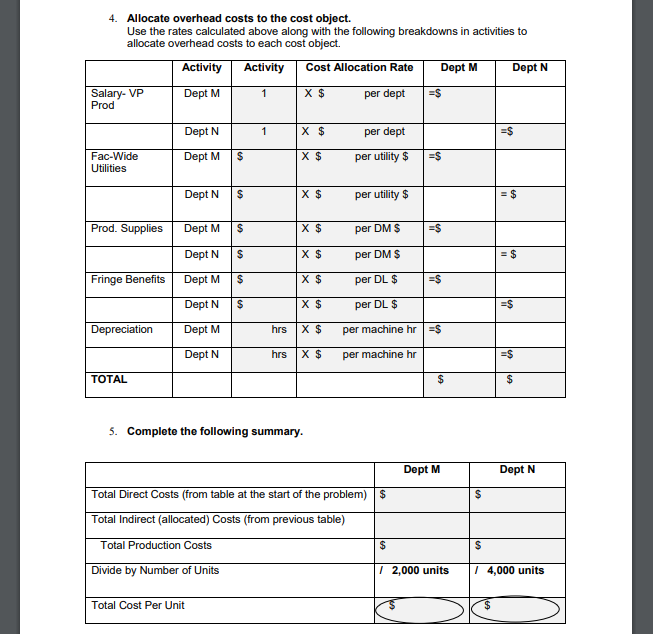

EXERCISE 2: Gerald Manufacturing makes two different Products, M and N. The company's two departments are named after the products. Product M is made in Department M. Product N is made in Department N. Following are the annual costs and other information associated with these two products Indirect Costs Direct costs: Direct Costs: (Overhead) Dept M Dept N Salary- VP of Overall Production $180,000 $56,000 Salary- Department Supervison $76,000 Direct Materials $300,000 $420,000 Direct Labor $240,000 $680,000 Direct Utilities Cost $120,000 $24,000 General Factory-wide Utilities $36,000 Production Supplies $36,000 Fringe Benefits $138,000 $720,000 Depreciation TOTAL OVERHEAD $1,110,000 Machine Hours 5,000 hrs 1,000 hrs Gerald Manufacturing uses an ABC Costing system. Follow these steps: 1. Identify the cost objects that will be allocated overhead costs (See completed analysis below): Allocation Cost Object Overhead Costs Dept M $1,110,000 Cost Object Dept N 2. Pool all activities with the same cost driver (See completed analysis below): Match the following possible cost drivers to each activity. Remember, you are looking for a cause and effect relationship between the activity and cost driver. Machine Hours Direct Materials $ Direct Utility Direct Labor $ Number of Departments Activity Pool Cost Driver Number of Departments Salary- VP of Overall Production General Factory-wide Utilities Direct Utility $ Production Supplies Direct Materials $ Fringe Benefits Direct Labor $ Depreciation Machine Hours 3. Compute the Cost Allocation Rate for each activity. Hint: For the Quantity of the Allocation base, be sure to use the EXACT cost driver description in Step 2 to correctly locate the "quantity" in the table at the start of the problem. Activity Quantity of Allocation Base Overhead Costs Cost Allocation Rate Salary- VP Prod Departments per dept S Direct Utilities $ Fac-Wide Uti lities S S per utility $ Prod. Supplies S S Direct Materials $ per DM $ Fringe Benefits S S Direct Labor S per DL $ S Depreciation Machine Hours per machine hr TOTAL 1,110,000 4. Allocate overhead costs to the cost object. Use the rates calculated above along with the following breakdowns in activities to allocate overhead costs to each cost object. Activity Activity Dept M Dept N Cost Allocation Rate Salary- VP Prod X S per dept Dept M X $ Dept N per dept S X S Fac-Wide Dept M per utility $ Utilities Dept N X $ per utility $ Prod. Supplies X $ Dept M per DM S Dept N X $ per DM S Fringe Benefits X $ Dept M per DL $ Dept N per DL S Dept M hrs X $ Depreciation per machine hr hrs X $ Dept N per machine hr TOTAL 5. Complete the following summary. Dept M Dept N Total Direct Costs (from table at the start of the problem) $ S Total Indirect (allocated) Costs (from previous table) $ Total Production Costs 2,000 units 4,000 units Divide by Number of Units Total Cost Per Unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts