Question: Exercise 2. Many MNEs have greater ability to control and reduce their effective tax rates when expanding international operations. If Genedak-Hogan was able to reduce

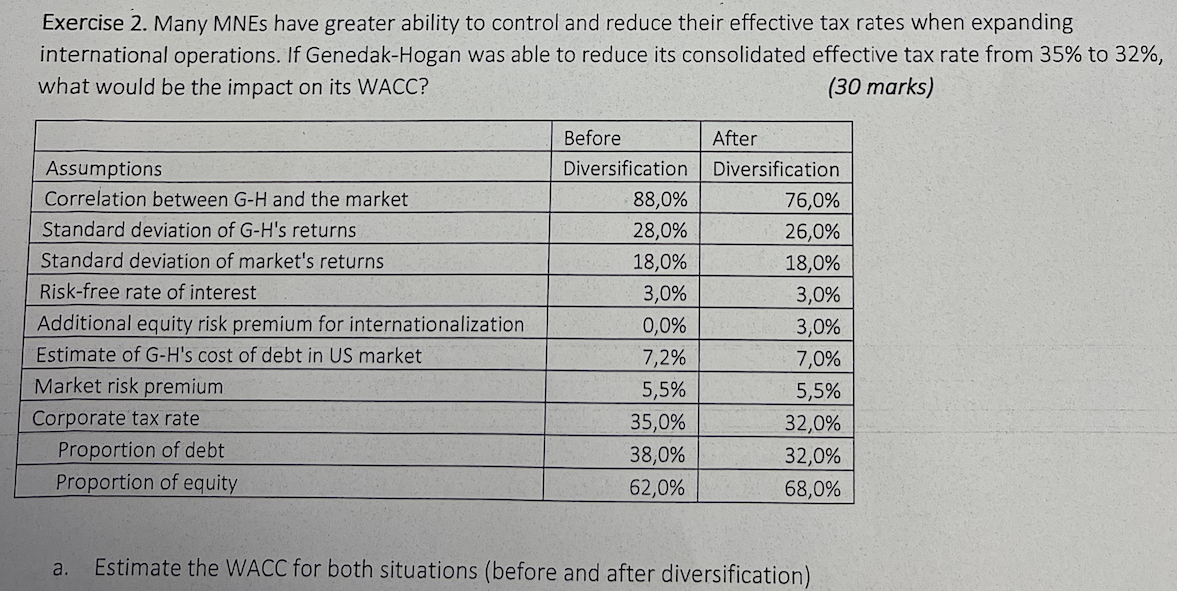

Exercise 2. Many MNEs have greater ability to control and reduce their effective tax rates when expanding international operations. If Genedak-Hogan was able to reduce its consolidated effective tax rate from 35% to 32%, what would be the impact on its WACC? (30 marks) Before After Assumptions Diversification Diversification Correlation between G-H and the market 88,0% 76,0% Standard deviation of G-H's returns 28,0% 26,0% Standard deviation of market's returns 18,0% 18,0% Risk-free rate of interest 3,0% 3,0% Additional equity risk premium for internationalization 0,0% 3,0% Estimate of G-H's cost of debt in US market 7,2% 7,0% Market risk premium 5,5% 5,5% Corporate tax rate 35,0% 32,0% Proportion of debt 38,0% 32,0% Proportion of equity 62,0% 68,0% a. Estimate the WACC for both situations (before and after diversification)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts