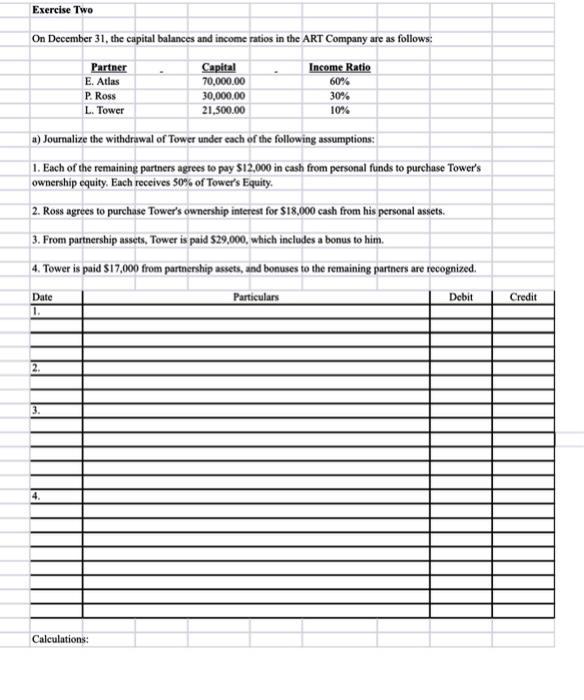

Question: exercise 2 please Exercise Two On December 31, the capital balances and income ratios in the ART Company are as follows: Partner Capital Income Ratio

Exercise Two On December 31, the capital balances and income ratios in the ART Company are as follows: Partner Capital Income Ratio E. Atlas 70,000.00 60% P. Ross 30,000.00 30% L. Tower 21,500.00 10% a) Journalize the withdrawal of Tower under each of the following assumptions: 1. Each of the remaining partners agrees to pay $12,000 in cash from personal funds to purchase Tower's ownership equity. Each receives 50% of Tower's Equity. 2. Ross agrees to purchase Tower's ownership interest for $18,000 cash from his personal assets. 3. From partnership assets, Tower is paid $29,000, which includes a bonus to him. 4. Tower is paid $17,000 from partnership assets, and bonuses to the remaining partners are recognized. Date Particulars Debit 1. 2. 4. Calculations: Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts