Question: Exercise 2. Suppose that there is one risk free asset with return rf and one risky asset with normally distributed returns, r ~ N(u,02). Show

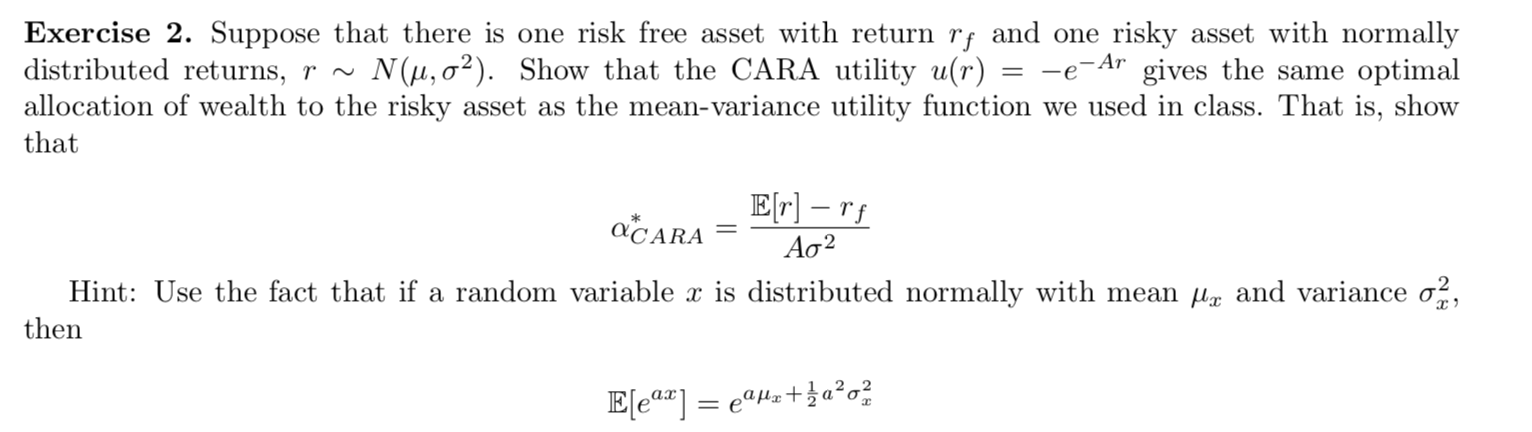

Exercise 2. Suppose that there is one risk free asset with return rf and one risky asset with normally distributed returns, r ~ N(u,02). Show that the CARA utility u(r) = -e-Ar gives the same optimal allocation of wealth to the risky asset as the mean-variance utility function we used in class. That is, show that ACARA = E[r] rf Ag2 Hint: Use the fact that if a random variable x is distributed normally with mean Me and variance 02, then E[eax] = eqHz+a?o? Exercise 2. Suppose that there is one risk free asset with return rf and one risky asset with normally distributed returns, r ~ N(u,02). Show that the CARA utility u(r) = -e-Ar gives the same optimal allocation of wealth to the risky asset as the mean-variance utility function we used in class. That is, show that ACARA = E[r] rf Ag2 Hint: Use the fact that if a random variable x is distributed normally with mean Me and variance 02, then E[eax] = eqHz+a?o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts