Question: Exercise 20-12 (LO. 1) Sunset Corporation, with E & P of $400,000, makes a cash distribution of $120,000 to a shareholder. The shareholder's basis in

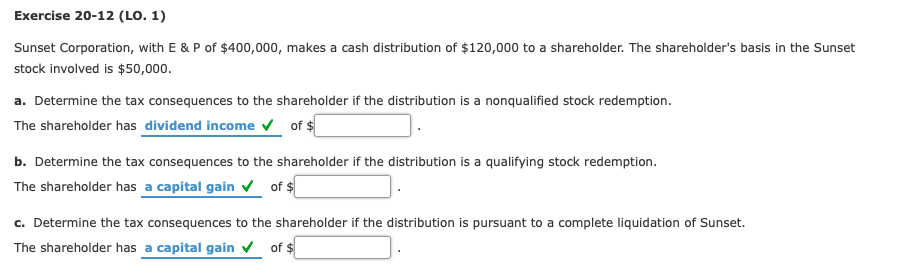

Exercise 20-12 (LO. 1) Sunset Corporation, with E & P of $400,000, makes a cash distribution of $120,000 to a shareholder. The shareholder's basis in the Sunset stock involved is $50,000 a. Determine the tax consequences to the shareholder if the distribution is a nonqualified stock redemption The shareholder has dividend incomeof b. Determine the tax consequences to the shareholder if the distribution is a qualifying stock redemption The shareholder has a capital gain of c. Determine the tax consequences to the shareholder if the distribution is pursuant to a complete liquidation of Sunset. The shareholder has a capital gain of $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts