Question: Exercise 20-14 Johnson Enterprises uses a computer to handle its sales invoices. Lately, business has been so good that it takes an extra 3 hours

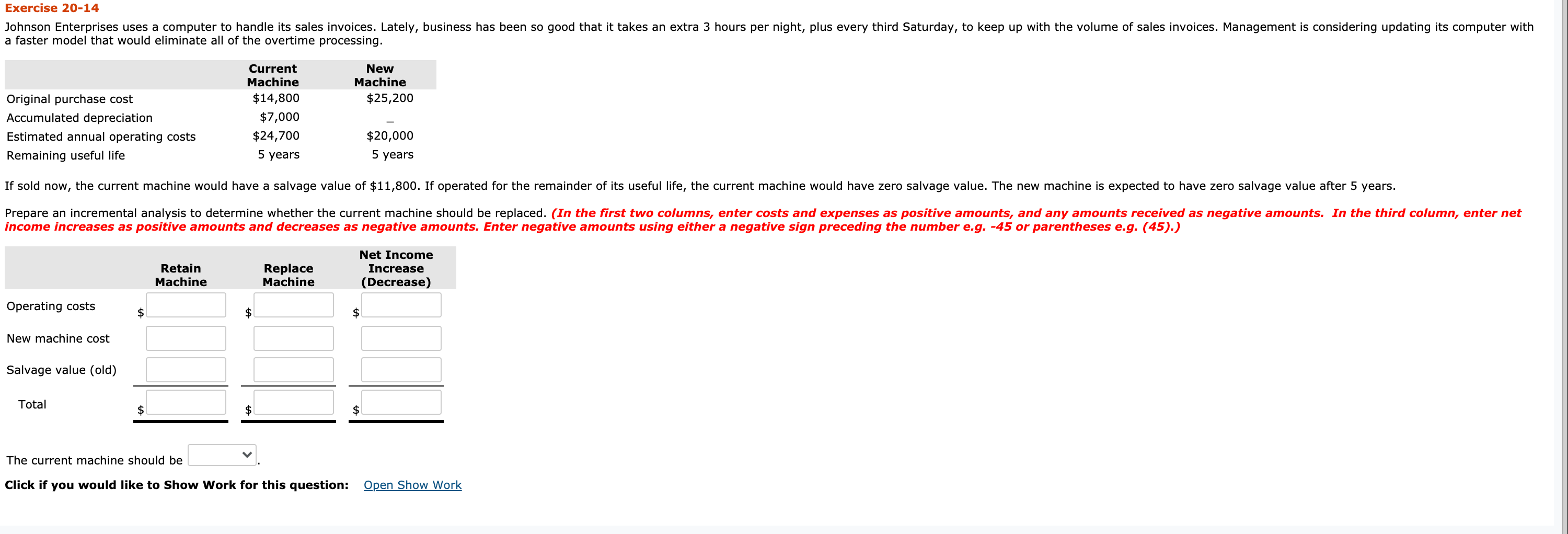

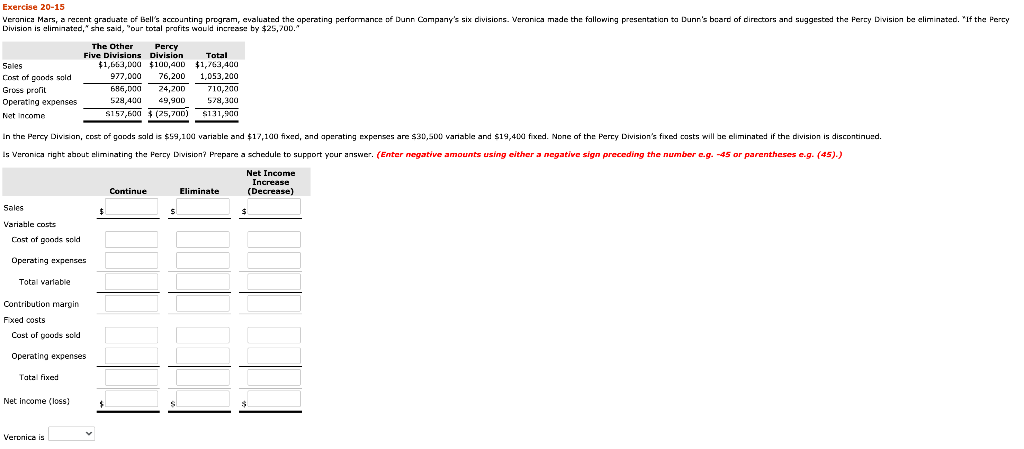

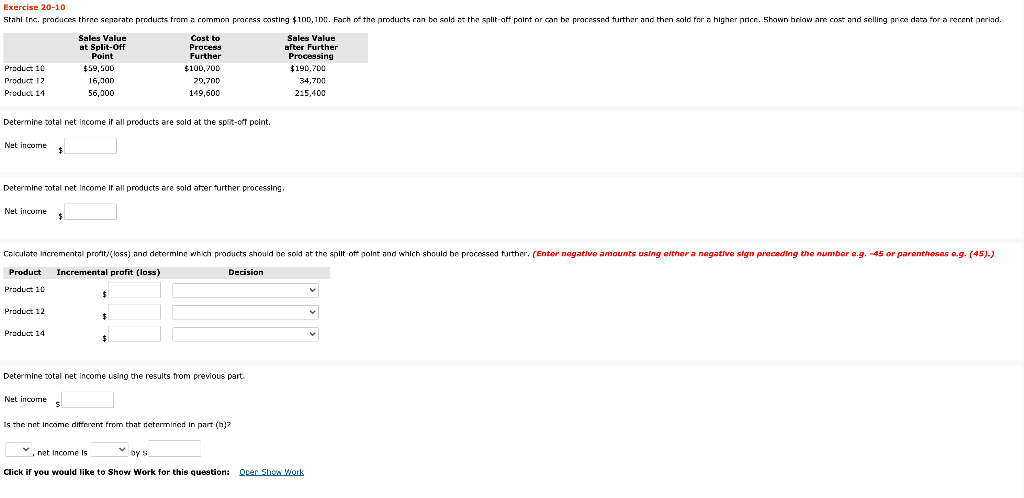

Exercise 20-14 Johnson Enterprises uses a computer to handle its sales invoices. Lately, business has been so good that it takes an extra 3 hours per night, plus every third Saturday, to keep up with the volume of sales invoices. Management is considering updating its computer with a faster model that would eliminate all of the overtime processing. Current Machine $14,800 $7,000 $24,700 New Machine $25,200 Original purchase cost Accumulated depreciation Estimated annual operating costs Remaining useful life $20,000 5 years 5 years If sold now, the current machine would have a salvage value of $11,800. If operated for the remainder of its useful life, the current machine would have zero salvage value. The new machine is expected to have zero salvage value after 5 years. Prepare an incremental analysis to determine whether the current machine should be replaced. (In the first two columns, enter costs and expenses as positive amounts, and any amounts received as negative amounts. In the third column, enter net income increases as positive amounts and decreases as negative amounts. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Retain Machine Replace Machine Net Income Increase (Decrease) Operating costs $ $ $ New machine cost Salvage value (old) Total $ $ $ The current machine should be Click if you would like to Show Work for this question: Open Show Work Exercise 20-15 Veranica Mars, a recent graduate of bell's accounting program, evaluated the aperating performance of Dunn Company's six divisions. Veronica made the following presentation to Dunn's board of directors and suggested the Ferry Division be eliminated. "If the Percy Division is eliminated," she said, "our total prafits would increase by $25,700." Sales Cost of goods sold Gross profit Operating expenses Net Income The Other Percy Five Divisions Division Total $1,613,000 $100,400 $1,763,400 977,000 76,200 1,053,200 696,000 24,200 710,200 529,400 49,900 578,300 S157,500 $ (75,700) $131,9%10 In the Percy Division, cost of goods sold is $59,100 variable and $17,100 fixed, and aperating expenses are $30,500 vanatic and $19,400 fixed. None of the Percy Division's fixed costs will se eliminated if the division is discontinued. Is Veronica right about eliminating the Percy Division? Prepare a schedule to support your answer. (Enter negative amounts using either a negative sign preceding the number c.g. -45 or parentheses e.g. (45).) Net Income Increase (Decrease Continue Eliminate $ S $ Sales Variable costs Cast of goods sold Operating expenses Total variable Contribution margin Fxed costs Cost of Quods sold Operating expenses Tatal fixed Net income (loss) Veronica is Exercise 20-10 Stahl Inc. produces three senarate products from a common process casting $100, 100. Each of the products can be sold at the salit-aff point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a recent period. Sales Value Cost to Sales Value at Split-Off Process after Further Point Further Processing Product 10 $59,500 $100,700 $190,700 Product 12 16,000 29,700 34,700 Product 14 56,000 149,600 215,400 Determine total net income if all products are sold at the spirit-off point. Net income $ Determine total net income if all products are sold after further processing Nel incurre $ Calculate Incremental profit/Class) and determine which products should be sold at the split off point and which should be processed further. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Product Incremental profit (loss) Decision Product 10 Product 12 $ $ Product 14 Determine total net income using the results from previous part. Net income s Is the net income different from that determined in part (h)? net income is bys Click if you would like to Show Work for this question: Qeer Show Viork

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts