Question: Exercise 21-19 Computing total overhead rate and total overhead variance LO P4 World Company expects to operate at 60% of its productive capacity of

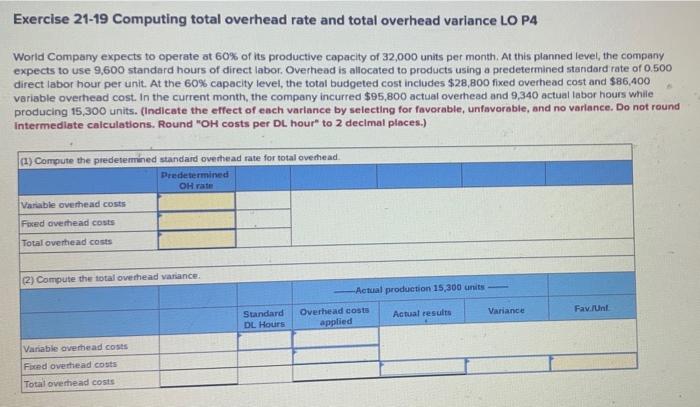

Exercise 21-19 Computing total overhead rate and total overhead variance LO P4 World Company expects to operate at 60% of its productive capacity of 32,000 units per month. At this planned level, the company expects to use 9,600 standard hours of direct labor. Overhead is allocated to products using a predetermined standard rate of 0.500 direct labor hour per unit. At the 60% capacity level, the total budgeted cost includes $28,800 fixed overhead cost and $86,400 variable overhead cost. In the current month, the company incurred $95,800 actual overhead and 9,340 actual labor hours while producing 15,300 units. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance. Do not round Intermediate calculations. Round "OH costs per DL hour" to 2 decimal places.) (1) Compute the predetermined standard overhead rate for total overhead. Variable overhead costs Fixed overhead costs Total overhead costs Predetermined OH rate (2) Compute the total overhead variance. Variable overhead costs Fixed overhead costs Total overhead costs -Actual production 15,300 units Standard DL Hours Overhead costs applied Actual results Fav./Unl Variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts