Question: Exercise 21-5 (Algo) Preparing flexible budget performance report LO P1 Nina Company prepared the following fixed budget for July using 7,560 units for budgeted sales.

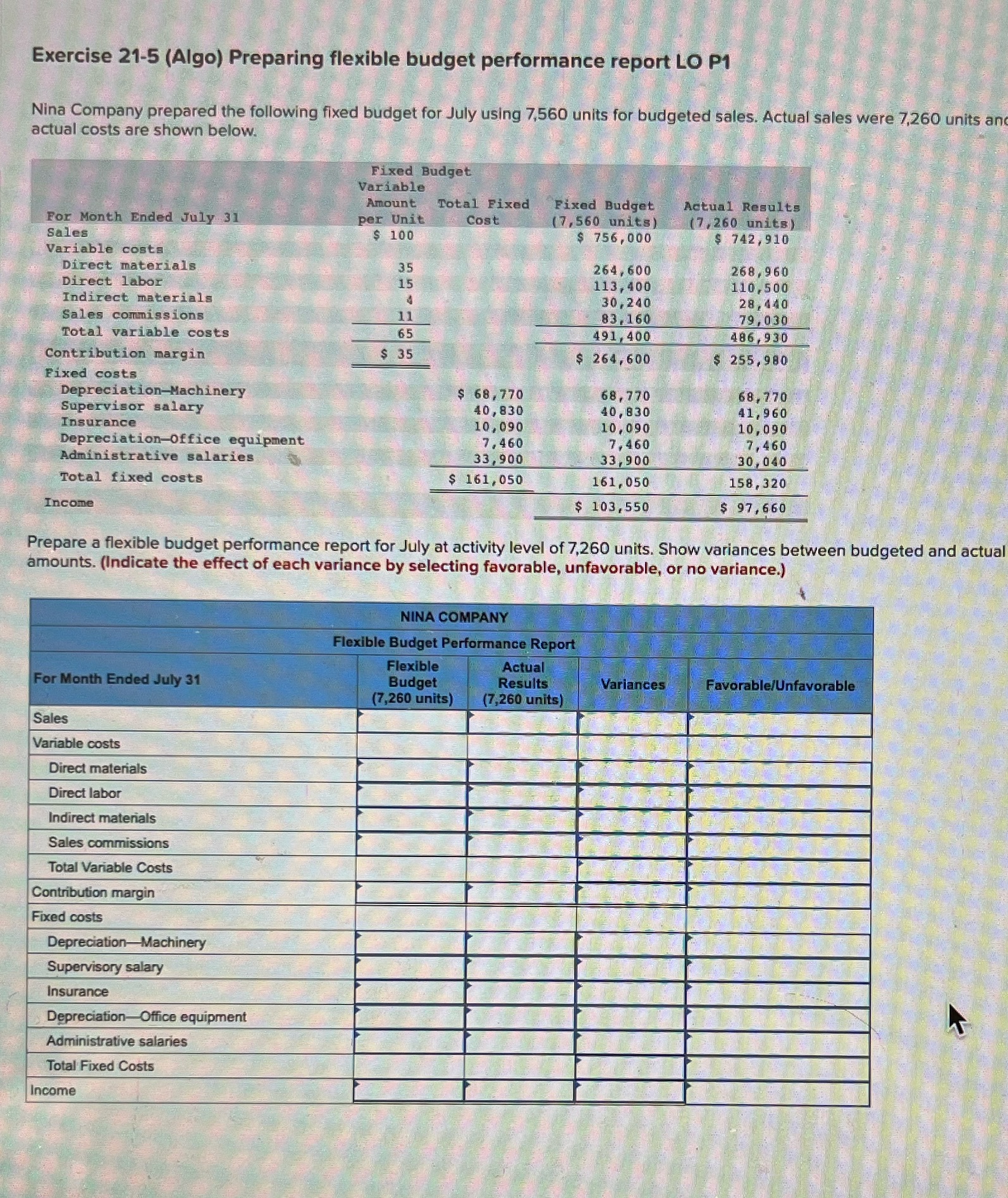

Exercise 21-5 (Algo) Preparing flexible budget performance report LO P1 Nina Company prepared the following fixed budget for July using 7,560 units for budgeted sales. Actual sales were 7,260 units an actual costs are shown below. Fixed Budget Variable Amount Total Fixed Fixed Budget Actual Results For Month Ended July 31 per Unit Cost (7,560 units) (7 , 260 units) Sales $ 100 $ 756,000 $ 742 , 910 Variable costa Direct materials 35 264, 600 268 , 960 Direct labor 15 113, 400 110,500 Indirect materials 4 30, 240 28, 140 Sales commissions 11 83,160 79, 030 Total variable costs 65 491, 400 486,930 Contribution margin $ 35 $ 264, 600 $ 255 , 980 Fixed costs Depreciation-Machinery $ 68, 770 68, 770 68, 770 Supervisor salary 40, 830 40, 830 11, 960 Insurance 10, 090 10 , 090 10, 090 Depreciation Office equipment 7, 460 7, 460 7, 460 Administrative salaries 33, 900 33, 900 30, 040 Total fixed costs $ 161, 050 161, 050 158 , 320 Income $ 103,550 $ 97, 660 Prepare a flexible budget performance report for July at activity level of 7,260 units. Show variances between budgeted and actual amounts. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) NINA COMPANY Flexible Budget Performance Report Flexible Actual For Month Ended July 31 Budget Results Variances Favorable/Unfavorable (7,260 units) (7,260 units) Sales Variable costs Direct materials Direct labor Indirect materials Sales commissions Total Variable Costs Contribution margin Fixed costs Depreciation-Machinery Supervisory salary Insurance Depreciation-Office equipment Administrative salaries Total Fixed Costs Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts