Question: Exercise 22-7 Presented below are the comparative income statements for Denise Habbe Inc. for the years 2014 and 2015. 2015 2014 Sales $ 337,410 $

Exercise 22-7

Presented below are the comparative income statements for Denise Habbe Inc. for the years 2014 and 2015.

| 2015 | 2014 | |||||

| Sales | $ 337,410 | $ 267,210 | ||||

| Cost of sales | 199,120 | 143,960 | ||||

| Gross profit | 138,290 | 123,250 | ||||

| Expenses | 86,110 | 47,470 | ||||

| Net income | $ 52,180 | $ 75,780 | ||||

| Retained earnings (Jan. 1) | $ 120,380 | $ 70,830 | ||||

| Net income | 52,180 | 75,780 | ||||

| Dividends | ( 27,820 ) | ( 26,230 ) | ||||

| Retained earnings (Dec. 31) | $ 144,740 | $ 120,380 | ||||

The following additional information is provided:

| 1. | In 2015, Denise Habbe Inc. decided to switch its depreciation method from sum-of-the-years-digits to the straight-line method. The assets were purchased at the beginning of 2014 for $ 85,500 with an estimated useful life of 4 years and no salvage value. (The 2015 income statement contains depreciation expense of $ 25,650 on the assets purchased at the beginning of 2014.) | |

| 2. | In 2015, the company discovered that the ending inventory for 2014 was overstated by $ 20,860 ; ending inventory for 2015 is correctly stated. |

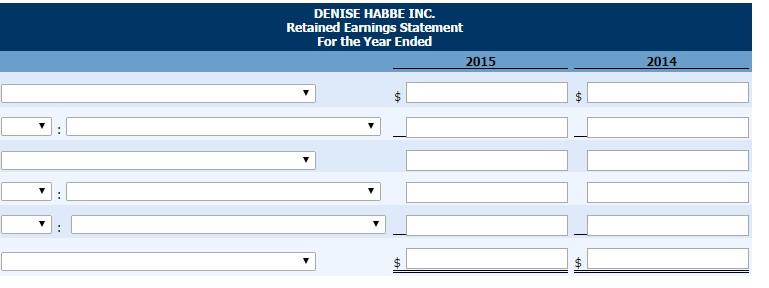

Prepare the revised retained earnings statement for 2014 and 2015, assuming comparative statements. (Ignore income taxes.)

DENISE HABBE INC. Retained Earnings Statement For the Year Ended 2014

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock