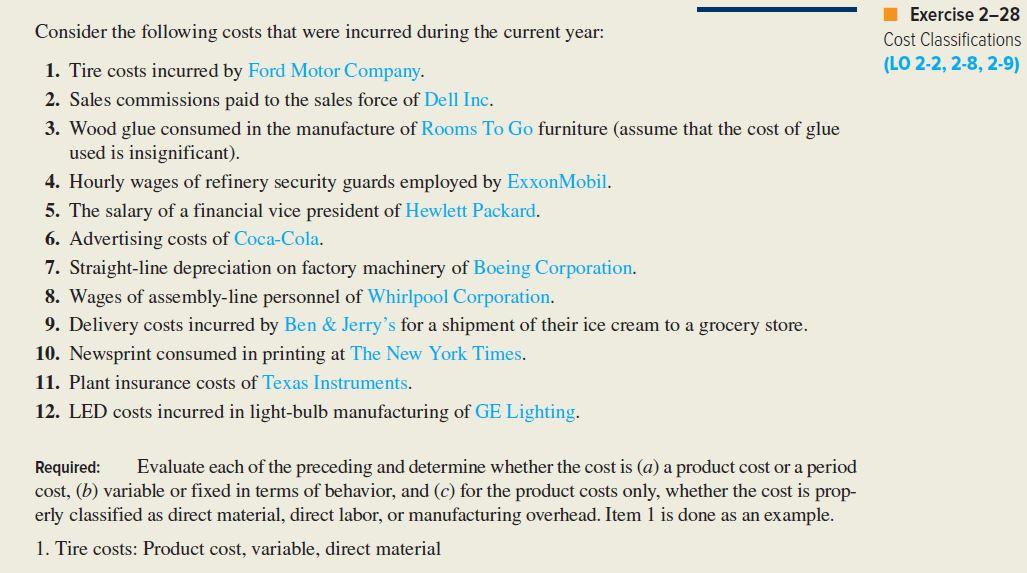

Question: Exercise 2-28 Cost Classifications (LO 2-2, 2-8, 2-9) Consider the following costs that were incurred during the current year: 1. Tire costs incurred by Ford

Exercise 2-28 Cost Classifications (LO 2-2, 2-8, 2-9) Consider the following costs that were incurred during the current year: 1. Tire costs incurred by Ford Motor Company. 2. Sales commissions paid to the sales force of Dell Inc. 3. Wood glue consumed in the manufacture of Rooms To Go furniture (assume that the cost of glue used is insignificant). 4. Hourly wages of refinery security guards employed by ExxonMobil. 5. The salary of a financial vice president of Hewlett Packard. 6. Advertising costs of Coca-Cola. 7. Straight-line depreciation on factory machinery of Boeing Corporation. 8. Wages of assembly-line personnel of Whirlpool Corporation. 9. Delivery costs incurred by Ben & Jerry's for a shipment of their ice cream to a grocery store. 10. Newsprint consumed in printing at The New York Times. 11. Plant insurance costs of Texas Instruments. 12. LED costs incurred in light-bulb manufacturing GE Lighting. Required: Evaluate each of the preceding and determine whether the cost is (a) a product cost or a period cost, (b) variable or fixed in terms of behavior, and (c) for the product costs only, whether the cost is prop- erly classified as direct material, direct labor, or manufacturing overhead. Item 1 is done as an example. 1. Tire costs: Product cost, variable, direct material

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts