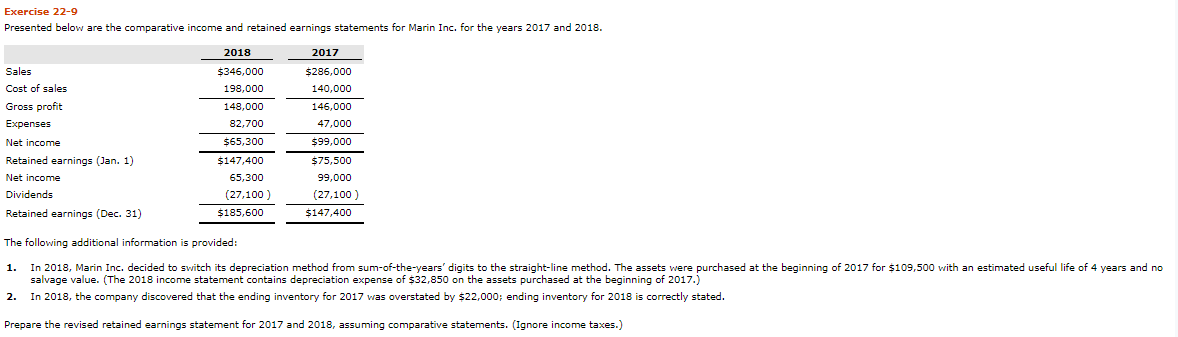

Question: Exercise 22-9 Presented below are the comparative income and retained earnings statements for Marin Inc. for the years 2017 and 2018. 2017 Sales Cost of

Exercise 22-9 Presented below are the comparative income and retained earnings statements for Marin Inc. for the years 2017 and 2018. 2017 Sales Cost of sales Gross profit Expenses Net income Retained earnings (Jan. 1) Net income Dividends Retained earnings (Dec. 31) 2018 $346,000 198,000 148,000 82,700 $65,300 $147,400 65,300 (27,100) $185,600 $286,000 140,000 146,000 47,000 $99,000 $75,500 99,000 (27,100) $147,400 The following additional information is provided: 1. In 2018, Marin Inc. decided to switch its depreciation method from sum-of-the-years' digits to the straight-line method. The assets were purchased at the beginning of 2017 for $109,500 with an estimated useful life of 4 years and no salvage value. (The 2018 income statement contains depreciation expense of $32,850 on the assets purchased at the beginning of 2017.) In 2018, the company discovered that the ending inventory for 2017 was overstated by $22,000; ending inventory for 2018 is correctly stated. 2. Prepare the revised retained earnings statement for 2017 and 2018, assuming comparative statements. (Ignore income taxes.) MARIN INC. Retained Earnings Statement For the Year Ended 2018 2017 LINK TO TEXT LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts