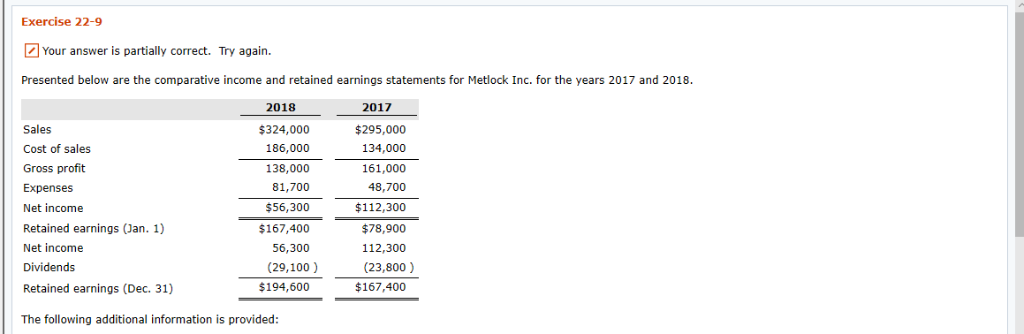

Question: Exercise 22-9 Your answer is partially correct. Try again. Presented below are the comparative income and retained earnings statements for Metlock Inc. for the years

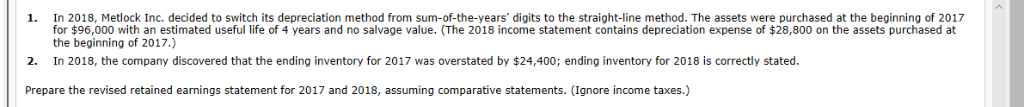

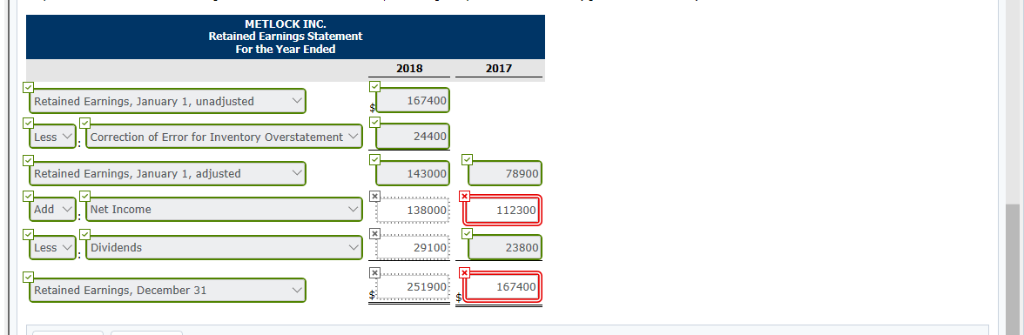

Exercise 22-9 Your answer is partially correct. Try again. Presented below are the comparative income and retained earnings statements for Metlock Inc. for the years 2017 and 2018 2018 2017 $295,000 134,000 161,000 48,700 $112,300 $78,900 112,300 (23,800) $167,400 Sales Cost of sales Gross profit Expenses Net income Retained earnings (Jan. 1) Net income Dividends Retained earnings (Dec. 31) $324,000 186,000 138,000 81,700 $56,300 $167,400 56,300 (29,100) $194,600 The following additional information is provided 1. In 2018, Metlock Inc. decided to switch its depreciation method from sum-of-the-years' digits to the straight-line method. The assets were purchased at the beginning of 2017 for $96,000 with an estimated useful life of 4 years and no salvage value. (The 2018 income statement contains depreciation expense of $28,800 on the assets purchased at the beginning of 2017.) In 2018, the company discovered that the ending inventory for 2017 was overstated by $24,400; ending inventory for 2018 is correctly stated. 2. Prepare the revised retained earnings statement for 2017 and 2018, assuming comparative statements. (Ignore income taxes.) ET LOCK INC. Retained Earnings Statement For the Year Ended 2017 2018 167400 Retained Earnings, January 1, unadjusted Less v Correction of Error for Inventory Overstatement Retained Earnings, January 1, adjusted 24400 143000 78900 Add Net Income 138000 112300 Dividends 29100 23800 Less 251900 167400 Retained Earnings, December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts