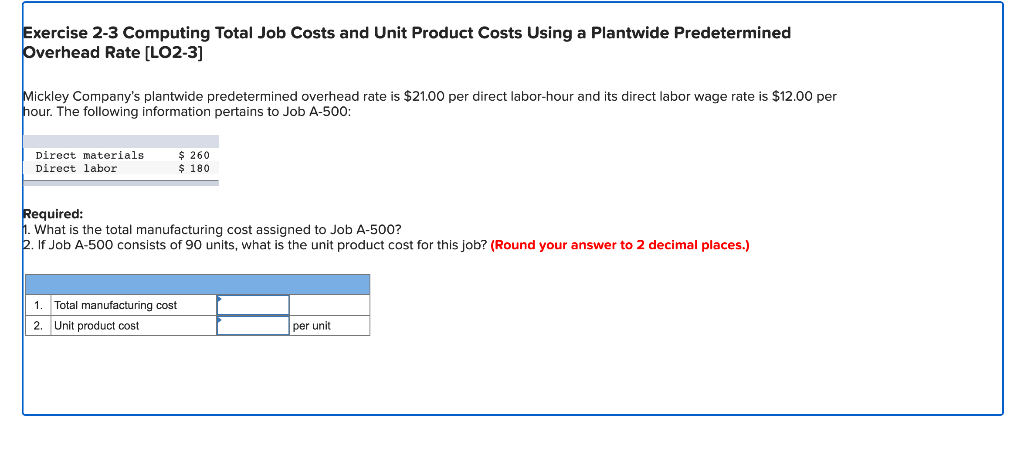

Question: Exercise 2-3 Computing Total Job Costs and Unit Product Costs Using a Plantwide Predetermined Overhead Rate [LO2-3] Mickley Company's plantwide predetermined overhead rate is $21.00

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock